Authors

Summary

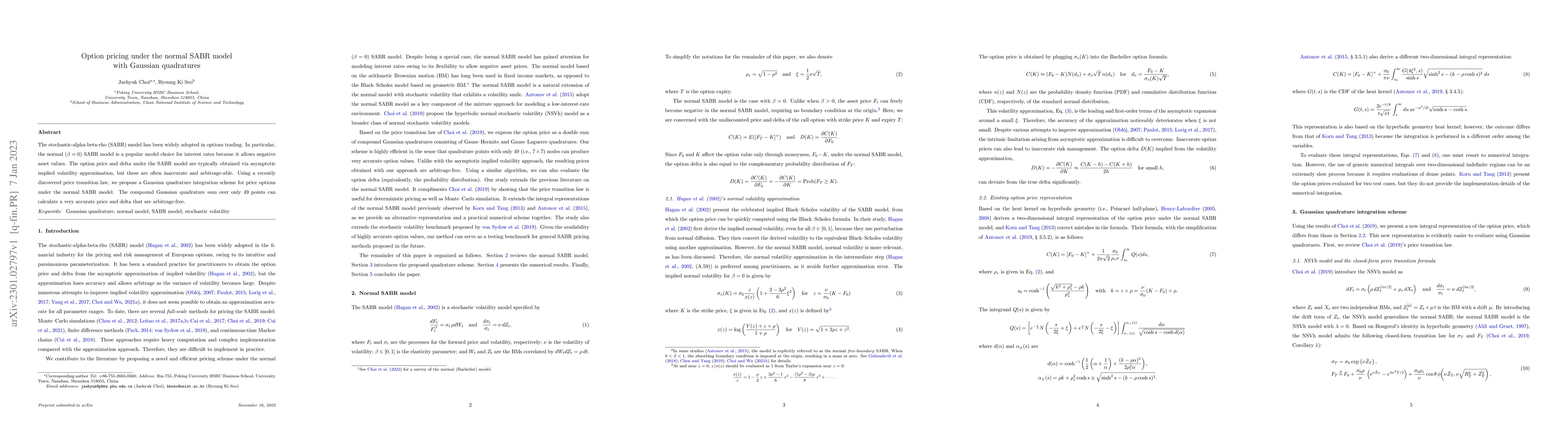

The stochastic-alpha-beta-rho (SABR) model has been widely adopted in options trading. In particular, the normal ($\beta=0$) SABR model is a popular model choice for interest rates because it allows negative asset values. The option price and delta under the SABR model are typically obtained via asymptotic implied volatility approximation, but these are often inaccurate and arbitrageable. Using a recently discovered price transition law, we propose a Gaussian quadrature integration scheme for price options under the normal SABR model. The compound Gaussian quadrature sum over only 49 points can calculate a very accurate price and delta that are arbitrage-free.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)