Summary

This study investigates how social media sentiment derived from Reddit comments can be used to enhance investment decisions in a way that offers higher returns with lower risk. Using BERTweet we analyzed over 2 million Reddit comments from the subreddit r/wallstreetbets and developed a Sentiment Volume Change (SVC) metric combining sentiment and comment volume changes, which showed significantly improved correlation with next-day returns compared to sentiment alone. We then implemented two different investment strategies that relied solely on SVC to make decisions. Back testing these strategies over four years (2020-2023) our strategies significantly outperformed a comparable buy-and-hold (B&H) strategy in a bull market, achieving 70% higher returns in 2023 and 84.4% higher returns in 2021 while also mitigating losses by 4% in a declining market in 2022. Our results confirm that comment sentiment and volume data derived from Reddit can be effective in predicting short-term stock price movements and sentiment-powered strategies can offer superior risk-adjusted returns as compared to the market, implying that social media sentiment can potentially be a valuable investment tool.

AI Key Findings

Generated Aug 06, 2025

Methodology

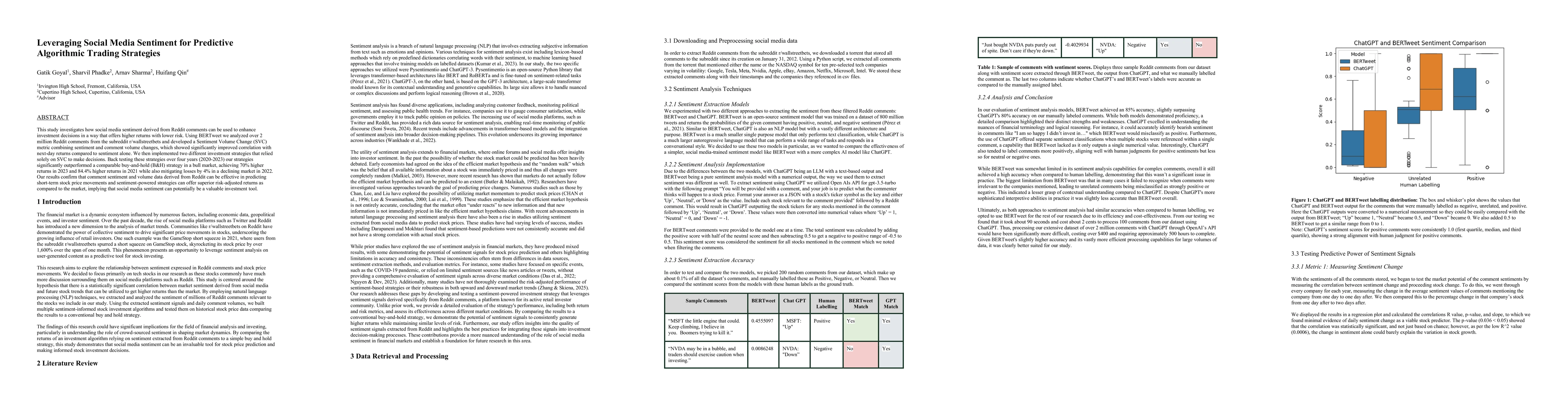

This study utilized BERTweet for sentiment analysis of Reddit comments from r/wallstreetbets, developing a Sentiment Volume Change (SVC) metric to enhance investment decisions.

Key Results

- The SVC metric showed significantly improved correlation with next-day returns compared to sentiment alone.

- Two investment strategies based on SVC outperformed a buy-and-hold strategy in a bull market, achieving 70% higher returns in 2023 and 84.4% higher returns in 2021.

- The strategies mitigated losses by 4% in a declining market in 2022.

- The sentiment-powered strategies offered superior risk-adjusted returns compared to the market.

Significance

This research confirms that social media sentiment derived from Reddit can be an effective tool for predicting short-term stock price movements, potentially informing investment decisions.

Technical Contribution

The development of the Sentiment Volume Change (SVC) metric, combining sentiment and comment volume changes, for predictive algorithmic trading strategies.

Novelty

This work distinguishes itself by demonstrating the effectiveness of combining sentiment analysis with volume data from social media platforms for short-term stock price prediction.

Limitations

- The study's reliance on Reddit comments from r/wallstreetbets may introduce bias, as this subreddit may not represent broader market sentiment.

- The analysis did not consider the context of comments, potentially leading to misinterpretations of sentiment.

Future Work

- Expanding the study to incorporate additional data sources like Twitter or financial news sentiment.

- Improving model architecture and testing sentiment-based strategies across various market conditions.

Paper Details

PDF Preview

Similar Papers

Found 4 papersApplying News and Media Sentiment Analysis for Generating Forex Trading Signals

Oluwafemi F Olaiyapo

FinLlama: Financial Sentiment Classification for Algorithmic Trading Applications

Thanos Konstantinidis, Giorgos Iacovides, Mingxue Xu et al.

Comments (0)