Summary

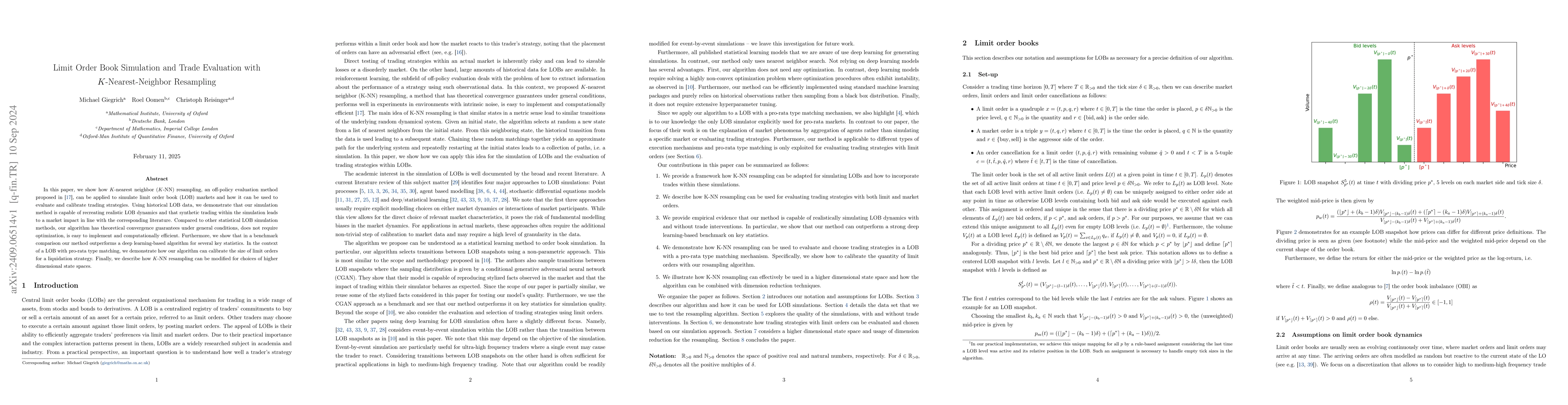

In this paper, we show how $K$-nearest neighbor ($K$-NN) resampling, an off-policy evaluation method proposed in \cite{giegrich2023k}, can be applied to simulate limit order book (LOB) markets and how it can be used to evaluate and calibrate trading strategies. Using historical LOB data, we demonstrate that our simulation method is capable of recreating realistic LOB dynamics and that synthetic trading within the simulation leads to a market impact in line with the corresponding literature. Compared to other statistical LOB simulation methods, our algorithm has theoretical convergence guarantees under general conditions, does not require optimization, is easy to implement and computationally efficient. Furthermore, we show that in a benchmark comparison our method outperforms a deep learning-based algorithm for several key statistics. In the context of a LOB with pro-rata type matching, we demonstrate how our algorithm can calibrate the size of limit orders for a liquidation strategy. Finally, we describe how $K$-NN resampling can be modified for choices of higher dimensional state spaces.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers$K$-Nearest-Neighbor Resampling for Off-Policy Evaluation in Stochastic Control

Christoph Reisinger, Michael Giegrich, Roel Oomen

No citations found for this paper.

Comments (0)