Summary

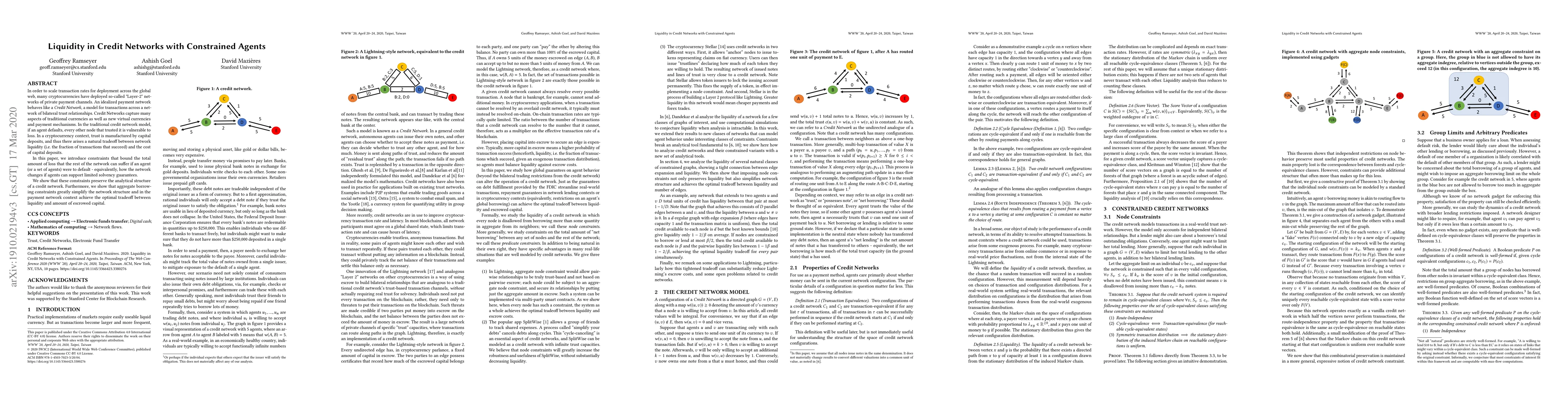

In order to scale transaction rates for deployment across the global web, many cryptocurrencies have deployed so-called "Layer-2" networks of private payment channels. An idealized payment network behaves like a Credit Network, a model for transactions across a network of bilateral trust relationships. Credit Networks capture many aspects of traditional currencies as well as new virtual currencies and payment mechanisms. In the traditional credit network model, if an agent defaults, every other node that trusted it is vulnerable to loss. In a cryptocurrency context, trust is manufactured by capital deposits, and thus there arises a natural tradeoff between network liquidity (i.e. the fraction of transactions that succeed) and the cost of capital deposits. In this paper, we introduce constraints that bound the total amount of loss that the rest of the network can suffer if an agent (or a set of agents) were to default - equivalently, how the network changes if agents can support limited solvency guarantees. We show that these constraints preserve the analytical structure of a credit network. Furthermore, we show that aggregate borrowing constraints greatly simplify the network structure and in the payment network context achieve the optimal tradeoff between liquidity and amount of escrowed capital.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)