Summary

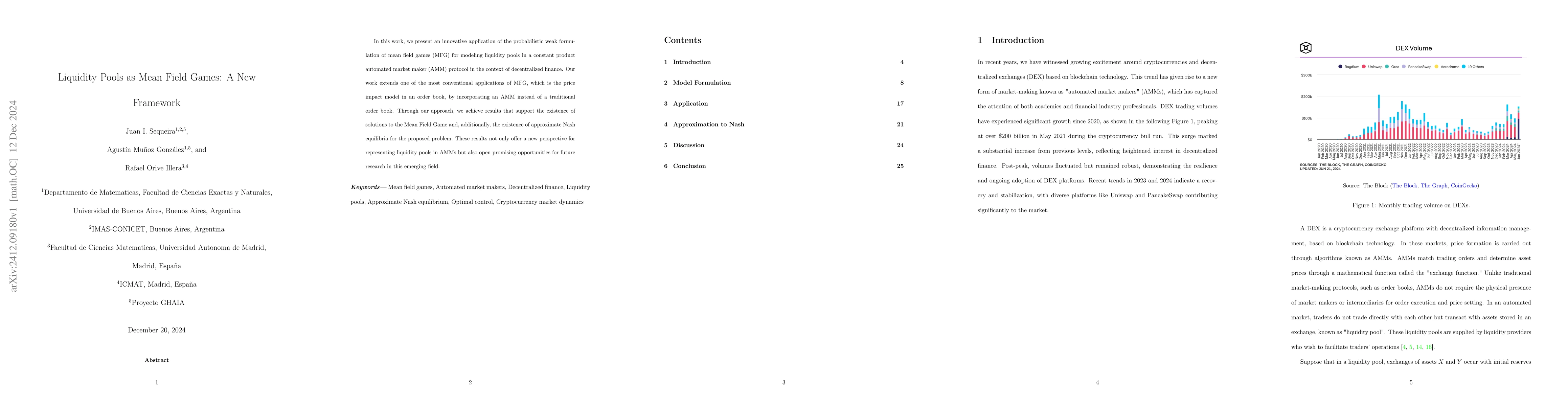

In this work, we present an innovative application of the probabilistic weak formulation of mean field games (MFG) for modeling liquidity pools in a constant product automated market maker (AMM) protocol in the context of decentralized finance. Our work extends one of the most conventional applications of MFG, which is the price impact model in an order book, by incorporating an AMM instead of a traditional order book. Through our approach, we achieve results that support the existence of solutions to the Mean Field Game and, additionally, the existence of approximate Nash equilibria for the proposed problem. These results not only offer a new perspective for representing liquidity pools in AMMs but also open promising opportunities for future research in this emerging field.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersA unifying framework for submodular mean field games

Max Nendel, Giorgio Ferrari, Jodi Dianetti et al.

Pooling Liquidity Pools in AMMs

Marcelo Bagnulo, Angel Hernando-Veciana, Efthymios Smyrniotis

No citations found for this paper.

Comments (0)