Summary

Let $\mathbb{F}\subset \mathbb{G}$ be two filtrations and $S$ be a $\mathbb{F}$ semimartingale possessing a $\mathbb{F}$ local martingale deflator. Consider $\tau$ a $\mathbb{G}$ stopping time. We study the problem whether $S^{\tau-}$ or $S^{\tau}$ can have $\mathbb{G}$ local martingale deflators. A suitable theoretical framework is set up in this paper, within which necessary/sufficient conditions for the problem to be solved have been proved. Under these conditions, we will construct $\mathbb{G}$ local martingale deflators for $S^{\tau-}$ or for $S^{\tau}$. Among others, it is proved that $\mathbb{G}$ local martingale deflators are multiples of $\mathbb{F}$ local martingale deflators, with a multiplicator coming from the multiplicative decomposition of the Az\'ema supermartingale of $\tau$. The proofs of the necessary/sufficient conditions require various results to be established about Az\'ema supermartingale, about local martingale deflator, about filtration enlargement, which are interesting in themselves. Our study is based on a filtration enlargement setting. For applications, it is important to have a method to infer the existence of such setting from the knowledge of the market information. This question is discussed at the end of the paper.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

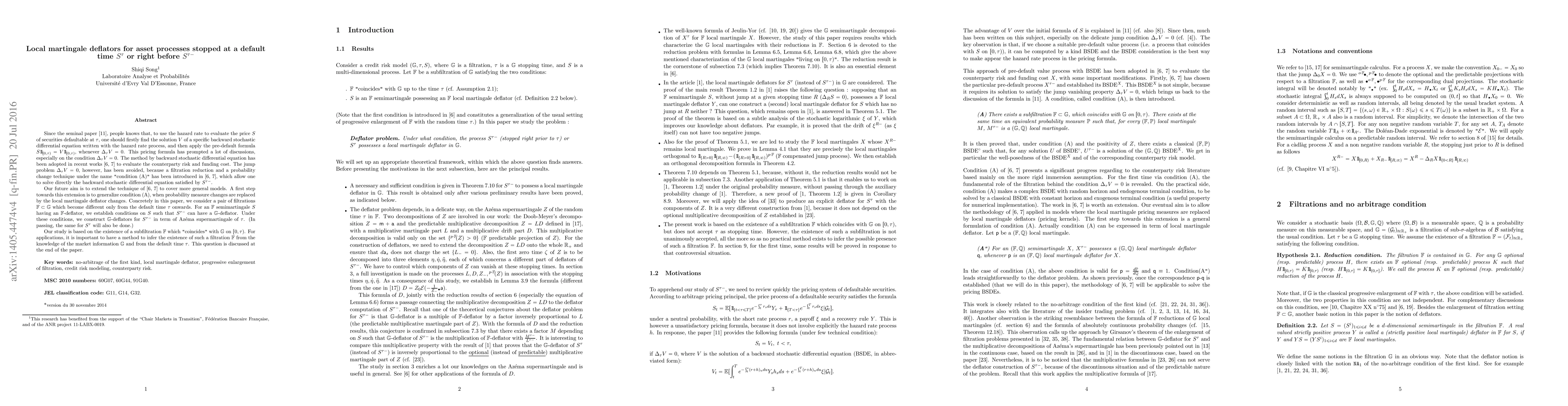

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)