Summary

A supermartingale deflator (resp., local martingale deflator) multiplicatively transforms nonnegative wealth processes into supermartingales (resp., local martingales). The supermartingale numeraire (resp., local martingale numeraire) is the wealth processes whose reciprocal is a supermartingale deflator (resp., local martingale deflator). It has been established in previous literature that absence of arbitrage of the first kind (NA1) is equivalent to existence of the supermartingale numeraire, and further equivalent to existence of a strictly positive local martingale deflator; however, under NA1, the local martingale numeraire may fail to exist. In this work, we establish that, under NA1, any total-variation neighbourhood of the original probability has an equivalent probability under which the local martingale numeraire exists. This result, available previously only for single risky-asset models, is in striking resemblance with the fact that any total-variation neighbourhood of a separating measure contains an equivalent $\sigma$-martingale measure. The presentation of our main result is relatively self-contained, including a proof of existence of the supermartingale numeraire under NA1. We further show that, if the Levy measures of the asset-price process have finite support, NA1 is equivalent to existence of the local martingale numeraire with respect to the original probability.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

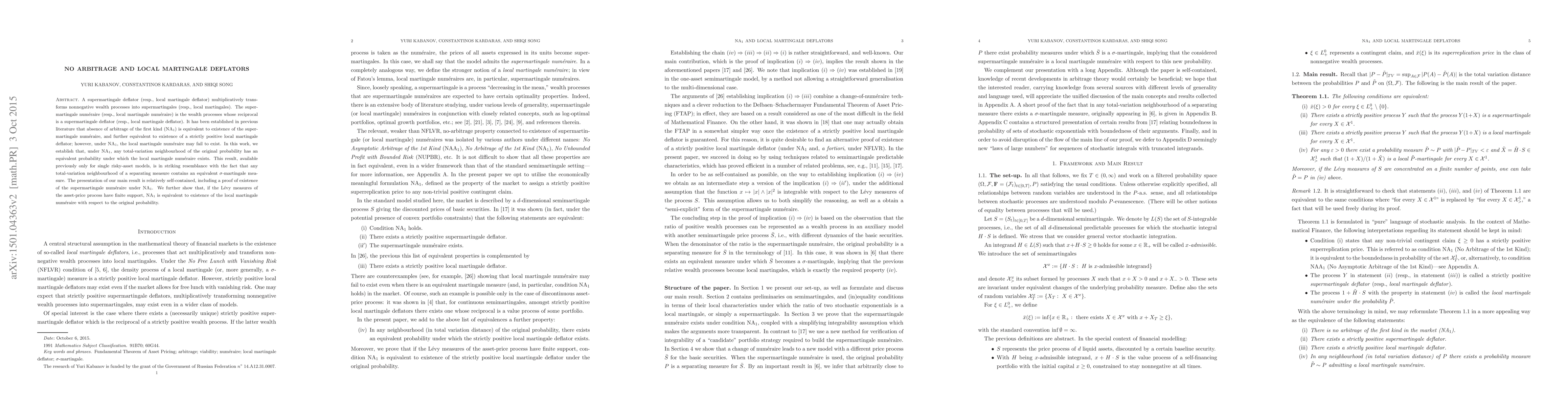

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)