Authors

Summary

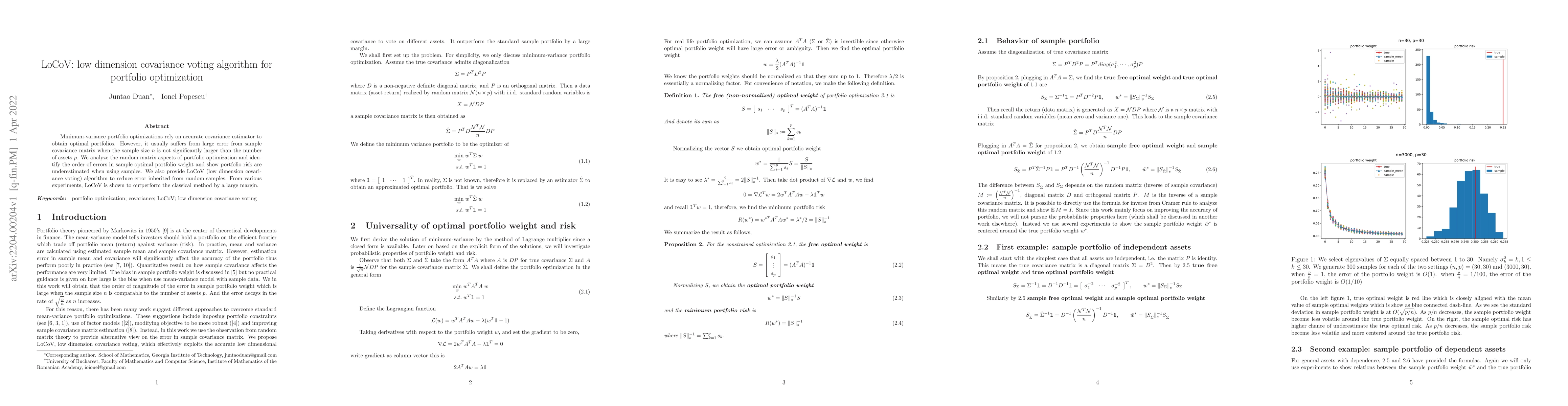

Minimum-variance portfolio optimizations rely on accurate covariance estimator to obtain optimal portfolios. However, it usually suffers from large error from sample covariance matrix when the sample size $n$ is not significantly larger than the number of assets $p$. We analyze the random matrix aspects of portfolio optimization and identify the order of errors in sample optimal portfolio weight and show portfolio risk are underestimated when using samples. We also provide LoCoV (low dimension covariance voting) algorithm to reduce error inherited from random samples. From various experiments, LoCoV is shown to outperform the classical method by a large margin.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDynamic Portfolio Optimization with Inverse Covariance Clustering

Tomaso Aste, Yuanrong Wang

No citations found for this paper.

Comments (0)