Summary

We study liquidity provision in the presence of exogenous competition. We consider a `reference market maker' who monitors her inventory and the aggregated inventory of the competing market makers. We assume that the competing market makers use a `rule of thumb' to determine their posted depths, depending linearly on their inventory. By contrast, the reference market maker optimises over her posted depths, and we assume that her fill probability depends on the difference between her posted depths and the competition's depths in an exponential way. For a linear-quadratic goal functional, we show that this model admits an approximate closed-form solution. We illustrate the features of our model and compare against alternative ways of solving the problem either via an Euler scheme or state-of-the-art reinforcement learning techniques.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

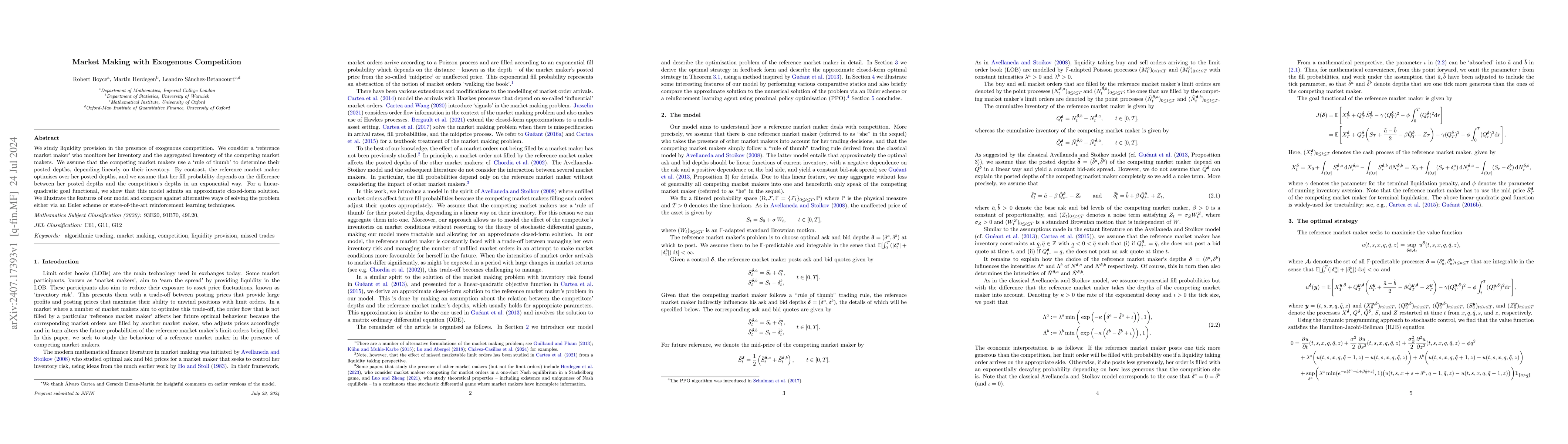

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDynamics of a Binary Option Market with Exogenous Information and Price Sensitivity

Christopher Griffin, Hannah Gampe

Market Making with Scaled Beta Policies

Rahul Savani, Gregory Palmer, Joseph Jerome

| Title | Authors | Year | Actions |

|---|

Comments (0)