Summary

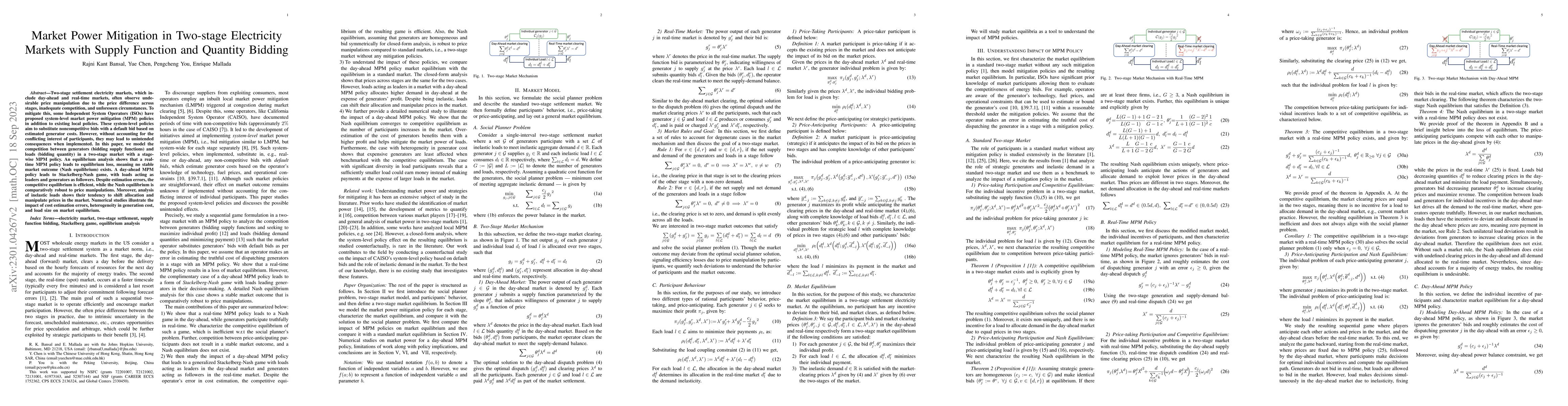

The main goal of a sequential two-stage electricity market -- e.g., day-ahead and real-time markets -- is to operate efficiently. However, the price difference across stages due to inadequate competition and unforeseen circumstances leads to undesirable price manipulation. To mitigate this, some Independent System Operators (ISOs) proposed system-level market power mitigation (MPM) policies in addition to existing local policies. These policies aim to substitute noncompetitive bids with a default bid based on estimated generator costs. However, these policies may lead to unintended consequences when implemented without accounting for the conflicting interest of participants. In this paper, we model the competition between generators (bidding supply functions) and loads (bidding quantity) in a two-stage market with a stage-wise MPM policy. An equilibrium analysis shows that a real-time MPM policy leads to equilibrium loss, meaning no stable market outcome (Nash equilibrium) exists. A day-ahead MPM policy, besides, leads to a Stackelberg-Nash game with loads acting as leaders and generators as followers. In this setting, loads become winners, i.e., their aggregate payment is always less than competitive payments. Moreover, comparison with standard market equilibrium highlights that markets are better off without such policies. Finally, numerical studies highlight the impact of heterogeneity and load size on market equilibrium.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersIntercept Function and Quantity Bidding in Two-stage Electricity Market with Market Power Mitigation

Yue Chen, Pengcheng You, Enrique Mallada et al.

A Market Mechanism for a Two-stage Settlement Electricity Market with Energy Storage

Patricia Hidalgo-Gonzalez, Enrique Mallada, Rajni Kant Bansal

Mitigation-Aware Bidding Strategies in Electricity Markets

James Anderson, Yiqian Wu, Jip Kim

Strategic Bidding in Electricity Markets with Convexified AC Market-Clearing Process

Saeed D. Manshadi, Arash Farokhi Soofi

| Title | Authors | Year | Actions |

|---|

Comments (0)