Authors

Summary

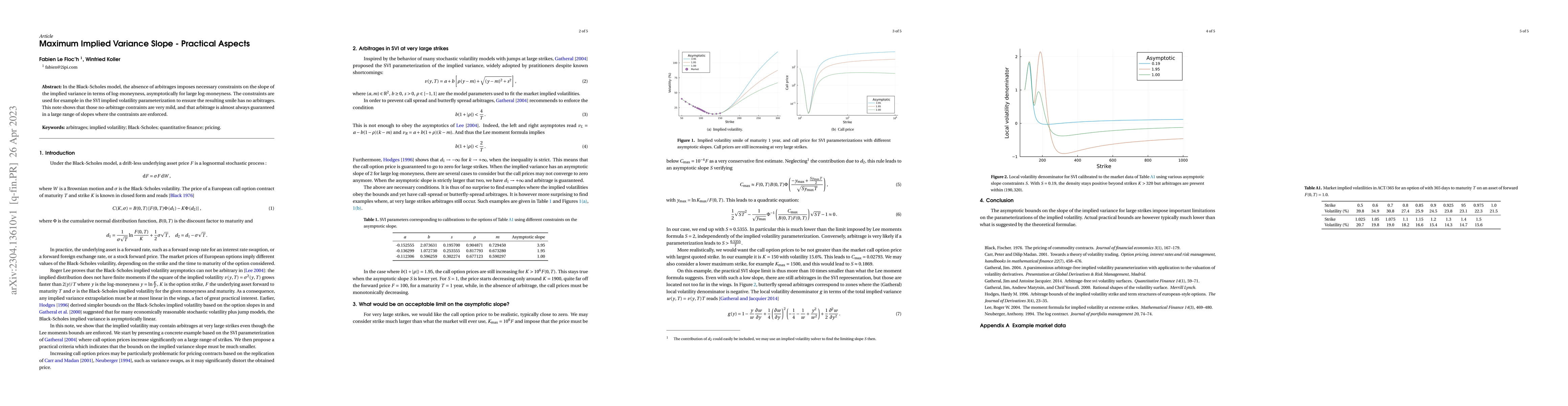

In the Black-Scholes model, the absence of arbitrages imposes necessary constraints on the slope of the implied variance in terms of log-moneyness, asymptotically for large log-moneyness. The constraints are used for example in the SVI implied volatility parameterization to ensure the resulting smile has no arbitrages. This note shows that those no-arbitrage contraints are very mild, and that arbitrage is almost always guaranteed in a large range of slopes where the contraints are enforced.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersThe ATM implied volatility slope, the (dual) volatility swap, and the (dual) zero vanna implied volatility

Frido Rolloos

W-shaped implied volatility curves in a variance-gamma mixture model

Martin Keller-Ressel

No citations found for this paper.

Comments (0)