Authors

Summary

This paper studies the mean field game (MFG) problem arising from a large population competition in fund management, featuring a new type of relative performance via the benchmark tracking constraint. In the n-agent model, each agent can strategically inject capital to ensure that the total wealth outperforms the benchmark process, which is modeled as a linear combination of the population's average wealth process and an exogenous market index process. That is, each agent is concerned about the performance of her competitors captured by the floor constraint. With a continuum of agents, we formulate the constrained MFG problem and transform it into an equivalent unconstrained MFG problem with a reflected state process. We establish the existence of the mean field equilibrium (MFE) using the PDE approach. Firstly, by applying the dual transform, the best response control of the representative agent can be characterized in analytical form in terms of a dual reflected diffusion process. As a novel contribution, we verify the consistency condition of the MFE in separated domains with the help of the duality relationship and properties of the dual process.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

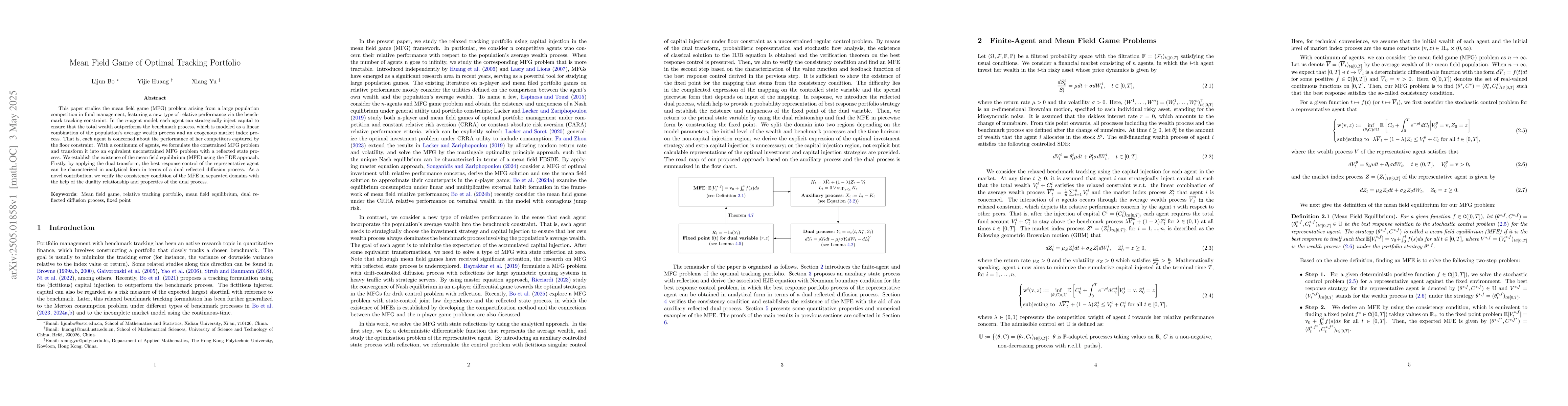

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Mean-Field Game of Market Entry: Portfolio Liquidation with Trading Constraints

Guanxing Fu, Paul P. Hager, Ulrich Horst

No citations found for this paper.

Comments (0)