Authors

Summary

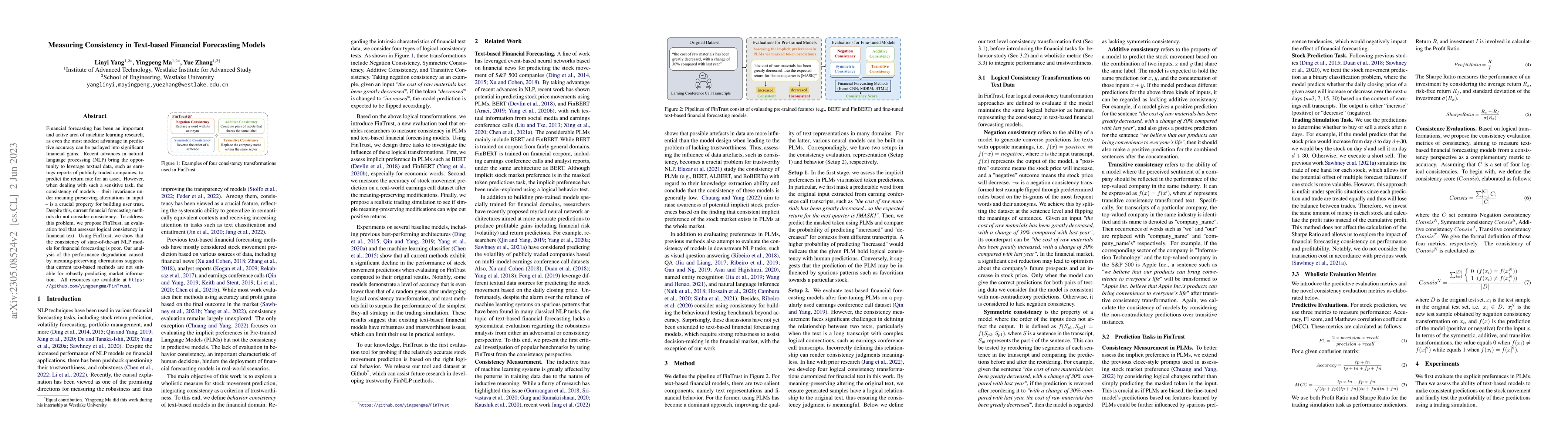

Financial forecasting has been an important and active area of machine learning research, as even the most modest advantage in predictive accuracy can be parlayed into significant financial gains. Recent advances in natural language processing (NLP) bring the opportunity to leverage textual data, such as earnings reports of publicly traded companies, to predict the return rate for an asset. However, when dealing with such a sensitive task, the consistency of models -- their invariance under meaning-preserving alternations in input -- is a crucial property for building user trust. Despite this, current financial forecasting methods do not consider consistency. To address this problem, we propose FinTrust, an evaluation tool that assesses logical consistency in financial text. Using FinTrust, we show that the consistency of state-of-the-art NLP models for financial forecasting is poor. Our analysis of the performance degradation caused by meaning-preserving alternations suggests that current text-based methods are not suitable for robustly predicting market information. All resources are available at https://github.com/yingpengma/fintrust.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersLarge Language Models for Financial Aid in Financial Time-series Forecasting

Md Khairul Islam, Ayush Karmacharya, Judy Fox et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)