Authors

Summary

Constructing the implied volatility surface (IVS) is reframed as a meta-learning problem training across trading days to learn a general process that reconstructs a full IVS from few quotes, eliminating daily recalibration. We introduce the Volatility Neural Process, an attention-based model that uses a two-stage training: pre-training on SABR-generated surfaces to encode a financial prior, followed by fine-tuning on market data. On S&P 500 options (2006-2023; out-of-sample 2019-2023), our model outperforms SABR, SSVI, Gaussian Process, and an ablation trained only on real data. Relative to the ablation, the SABR-induced prior reduces RMSE by about 40% and dominates in mid- and long-maturity regions where quotes are sparse. The learned prior suppresses large errors, providing a practical, data-efficient route to stable IVS construction with a single deployable model.

AI Key Findings

Generated Sep 16, 2025

Methodology

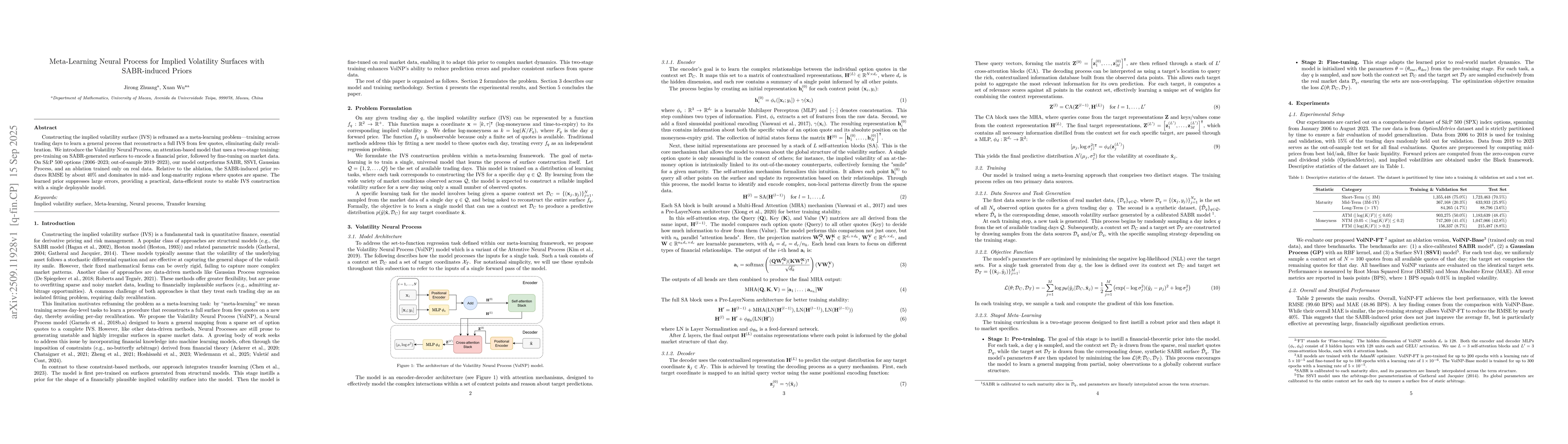

The paper introduces a meta-learning approach using a Volatility Neural Process (VolNP) model. It combines pre-training on SABR-generated synthetic data to encode a financial prior and fine-tuning on real market data to adapt to real-world dynamics. The model uses cross-attention mechanisms to aggregate contextual information for volatility surface reconstruction.

Key Results

- VolNP-FT outperforms SABR, SSVI, Gaussian Process, and an ablation model trained only on real data, achieving the lowest RMSE (99.60 BPS) and MAE (48.86 BPS).

- The SABR-induced prior reduces RMSE by about 40% compared to the ablation model, particularly improving performance in mid- and long-maturity regions with sparse quotes.

- VolNP-FT demonstrates superior data efficiency, maintaining lower RMSE across varying levels of data sparsity and producing more stable and reliable volatility surfaces.

Significance

This research provides a data-efficient, stable method for constructing implied volatility surfaces without daily recalibration, which is critical for financial risk management and derivative pricing. The approach bridges the gap between theoretical financial models and practical market data, offering a robust solution for volatility surface reconstruction.

Technical Contribution

The paper proposes a two-stage meta-learning framework that integrates a financial-theoretic prior (from SABR) with real market data, enabling the model to learn a generalizable mapping from sparse quotes to full volatility surfaces using attention-based mechanisms.

Novelty

The novelty lies in combining meta-learning with neural processes and leveraging SABR-induced priors to improve volatility surface reconstruction, particularly in data-scarce regions, while ensuring arbitrage-free properties through structured training.

Limitations

- The model's performance is evaluated on S&P 500 options data, limiting generalizability to other asset classes.

- The study focuses on volatility surface reconstruction but does not address other aspects of option pricing or risk management.

Future Work

- Extending the framework to other financial instruments beyond options, such as futures or swaps.

- Incorporating additional financial priors or constraints, such as jump diffusion models or stochastic volatility frameworks.

- Exploring the application of the model in real-time trading systems or risk management scenarios.

Paper Details

PDF Preview

Similar Papers

Found 4 papersSABR-Informed Multitask Gaussian Process: A Synthetic-to-Real Framework for Implied Volatility Surface Construction

Xuan Wu, Jirong Zhuang

Volatility Parametrizations with Random Coefficients: Analytic Flexibility for Implied Volatility Surfaces

Nicola F. Zaugg, Lech A. Grzelak, Leonardo Perotti

Comments (0)