Summary

We focus on the time-varying modeling of VaR at a given coverage $\tau$, assessing whether the quantiles of the distribution of the returns standardized by their conditional means and standard deviations exhibit predictable dynamics. Models are evaluated via simulation, determining the merits of the asymmetric Mean Absolute Deviation as a loss function to rank forecast performances. The empirical application on the Fama-French 25 value-weighted portfolios with a moving forecast window shows substantial improvements in forecasting conditional quantiles by keeping the predicted quantile unchanged unless the empirical frequency of violations falls outside a data-driven interval around $\tau$.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

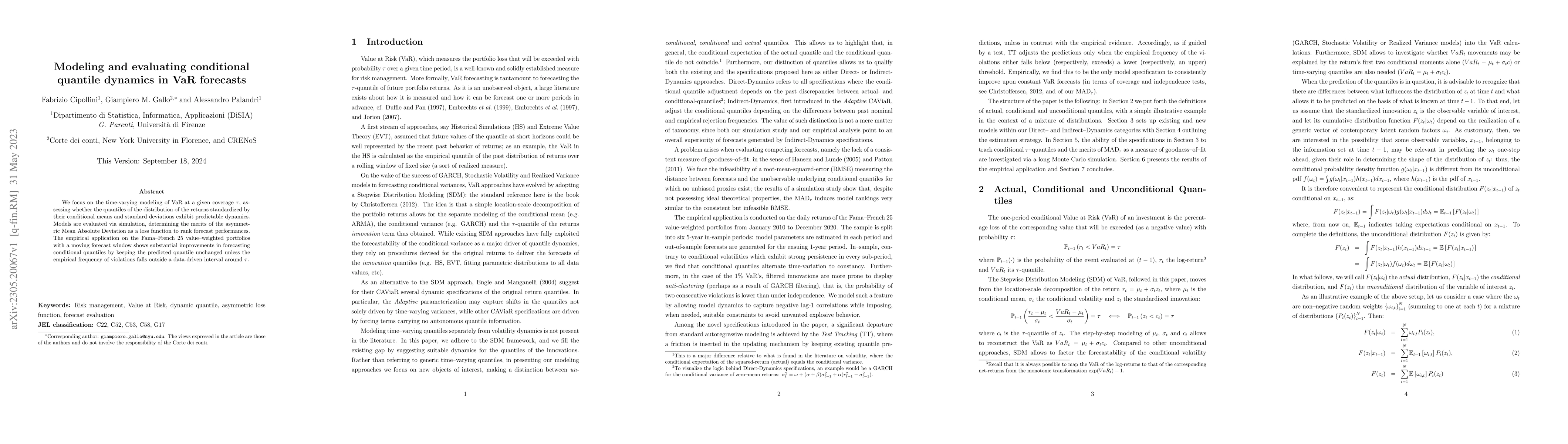

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)