Summary

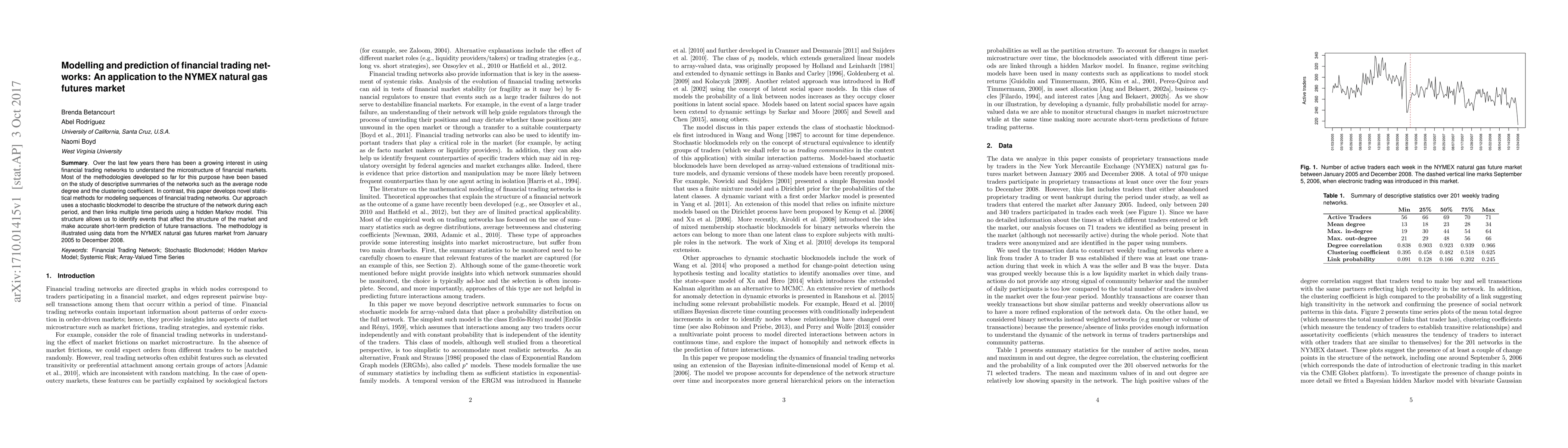

Over the last few years there has been a growing interest in using financial trading networks to understand the microstructure of financial markets. Most of the methodologies developed so far for this purpose have been based on the study of descriptive summaries of the networks such as the average node degree and the clustering coefficient. In contrast, this paper develops novel statistical methods for modeling sequences of financial trading networks. Our approach uses a stochastic blockmodel to describe the structure of the network during each period, and then links multiple time periods using a hidden Markov model. This structure allows us to identify events that affect the structure of the market and make accurate short-term prediction of future transactions. The methodology is illustrated using data from the NYMEX natural gas futures market from January 2005 to December 2008.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRisk-averse policies for natural gas futures trading using distributional reinforcement learning

Biagio Nigro, Félicien Hêche, Oussama Barakat et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)