Authors

Summary

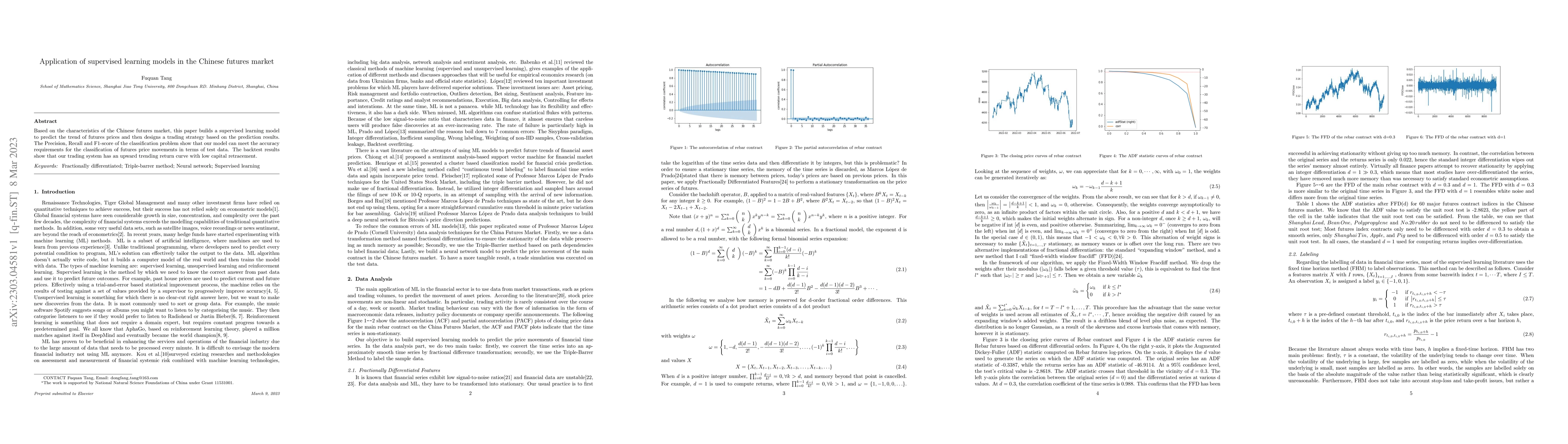

Based on the characteristics of the Chinese futures market, this paper builds a supervised learning model to predict the trend of futures prices and then designs a trading strategy based on the prediction results. The Precision, Recall and F1-score of the classification problem show that our model can meet the accuracy requirements for the classification of futures price movements in terms of test data. The backtest results show that our trading system has an upward trending return curve with low capital retracement.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersHigh-frequency lead-lag relationships in the Chinese stock index futures market: tick-by-tick dynamics of calendar spreads

Guanlin Li, Yingzheng Liu, Xiyan Chen

Unique futures in China: studys on volatility spillover effects of ferrous metal futures

Tingting Cao, Lin Hao, Weiqing Sun et al.

No citations found for this paper.

Comments (0)