Authors

Summary

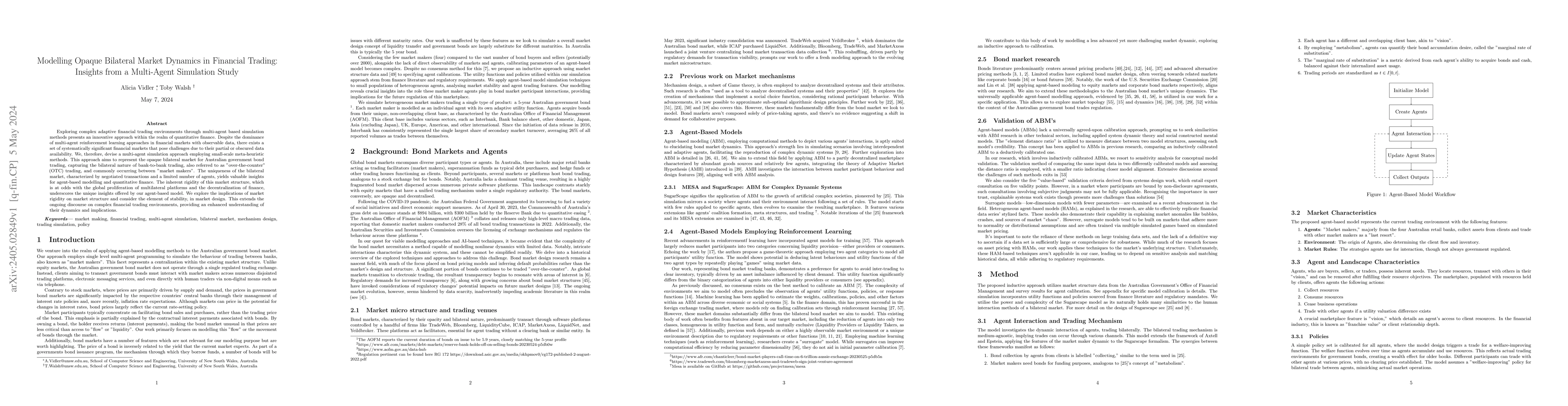

Exploring complex adaptive financial trading environments through multi-agent based simulation methods presents an innovative approach within the realm of quantitative finance. Despite the dominance of multi-agent reinforcement learning approaches in financial markets with observable data, there exists a set of systematically significant financial markets that pose challenges due to their partial or obscured data availability. We, therefore, devise a multi-agent simulation approach employing small-scale meta-heuristic methods. This approach aims to represent the opaque bilateral market for Australian government bond trading, capturing the bilateral nature of bank-to-bank trading, also referred to as "over-the-counter" (OTC) trading, and commonly occurring between "market makers". The uniqueness of the bilateral market, characterized by negotiated transactions and a limited number of agents, yields valuable insights for agent-based modelling and quantitative finance. The inherent rigidity of this market structure, which is at odds with the global proliferation of multilateral platforms and the decentralization of finance, underscores the unique insights offered by our agent-based model. We explore the implications of market rigidity on market structure and consider the element of stability, in market design. This extends the ongoing discourse on complex financial trading environments, providing an enhanced understanding of their dynamics and implications.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersHigh-frequency financial market simulation and flash crash scenarios analysis: an agent-based modelling approach

Wayne Luk, Kang Gao, Perukrishnen Vytelingum et al.

QuantAgents: Towards Multi-agent Financial System via Simulated Trading

Xiangmin Xu, Jin Xu, Yawen Zeng et al.

Shifting Power: Leveraging LLMs to Simulate Human Aversion in ABMs of Bilateral Financial Exchanges, A bond market study

Toby Walsh, Alicia Vidler

HedgeAgents: A Balanced-aware Multi-agent Financial Trading System

Xiangmin Xu, Jin Xu, Yawen Zeng et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)