Summary

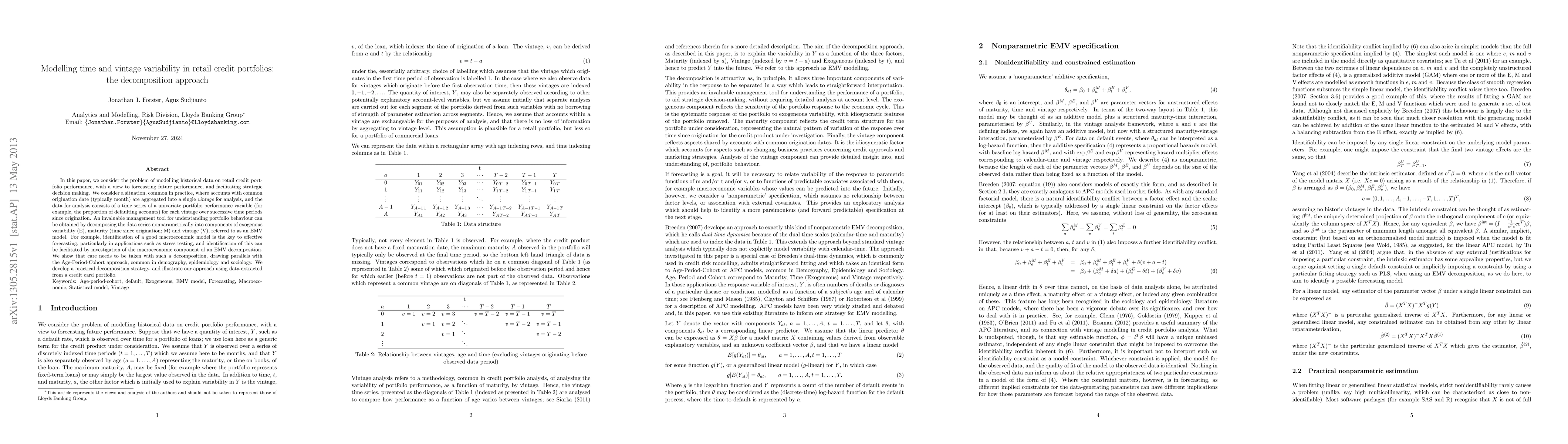

In this paper, we consider the problem of modelling historical data on retail credit portfolio performance, with a view to forecasting future performance, and facilitating strategic decision making. We consider a situation, common in practice, where accounts with common origination date (typically month) are aggregated into a single vintage for analysis, and the data for analysis consists of a time series of a univariate portfolio performance variable (for example, the proportion of defaulting accounts) for each vintage over successive time periods since origination. An invaluable management tool for understanding portfolio behaviour can be obtained by decomposing the data series nonparametrically into components of exogenous variability (E), maturity (time since origination; M) and vintage (V), referred to as an EMV model. For example, identification of a good macroeconomic model is the key to effective forecasting, particularly in applications such as stress testing, and identification of this can be facilitated by investigation of the macroeconomic component of an EMV decomposition. We show that care needs to be taken with such a decomposition, drawing parallels with the Age-Period-Cohort approach, common in demography, epidemiology and sociology. We develop a practical decomposition strategy, and illustrate our approach using data extracted from a credit card portfolio.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersVintage-Based Formulations in Multi-Year Investment Modelling for Energy Systems

Ni Wang, Germán Morales-España

| Title | Authors | Year | Actions |

|---|

Comments (0)