Authors

Summary

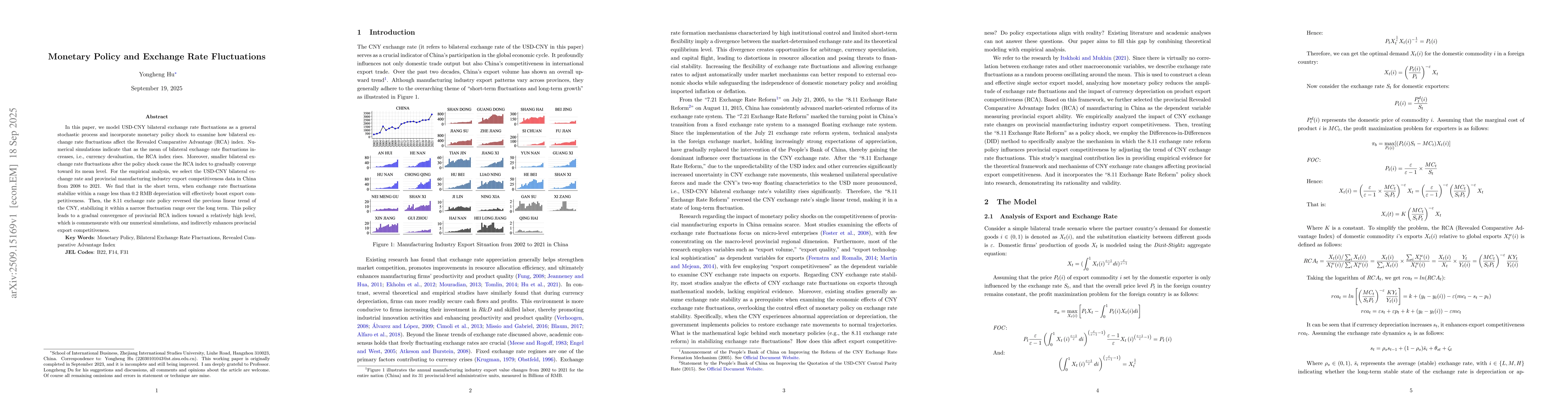

In this paper, we model USD-CNY bilateral exchange rate fluctuations as a general stochastic process and incorporate monetary policy shock to examine how bilateral exchange rate fluctuations affect the Revealed Comparative Advantage (RCA) index. Numerical simulations indicate that as the mean of bilateral exchange rate fluctuations increases, i.e., currency devaluation, the RCA index rises. Moreover, smaller bilateral exchange rate fluctuations after the policy shock cause the RCA index to gradually converge toward its mean level. For the empirical analysis, we select the USD-CNY bilateral exchange rate and provincial manufacturing industry export competitiveness data in China from 2008 to 2021. We find that in the short term, when exchange rate fluctuations stabilize within a range less than 0.2 RMB depreciation will effectively boost export competitiveness. Then, the 8.11 exchange rate policy reversed the previous linear trend of the CNY, stabilizing it within a narrow fluctuation range over the long term. This policy leads to a gradual convergence of provincial RCA indices toward a relatively high level, which is commensurate with our numerical simulations, and indirectly enhances provincial export competitiveness.

AI Key Findings

Generated Sep 30, 2025

Methodology

The study employs a combination of econometric analysis, including difference-in-differences (DID) models and two-stage least squares (2SLS) regression, to evaluate the impact of exchange rate reforms on provincial export competitiveness. It uses provincial-level data on real exchange rates and export competitiveness measured by RCA indices.

Key Results

- Depreciation of the USD-CNY exchange rate within the 6-7 range significantly enhances provincial export competitiveness.

- Short-term exchange rate volatility below 0.2 RMB stabilizes export competitiveness improvements.

- The 8.11 Exchange Rate Reform effectively regulated exchange rate flexibility, reversing previous appreciation trends and promoting long-term stability.

Significance

This research provides critical insights for policymakers on how exchange rate management can influence export competitiveness, with implications for trade policy and economic development strategies in China and other emerging economies.

Technical Contribution

Develops a comprehensive econometric framework combining DID and 2SLS methods to analyze exchange rate impacts on export competitiveness while addressing endogeneity issues through instrumental variables.

Novelty

Introduces a dual focus on both exchange rate depreciation effects and volatility impacts, combined with a specific policy evaluation of the 8.11 reform, offering new perspectives on exchange rate management strategies.

Limitations

- Relies on historical data which may not fully capture current market dynamics

- Assumes linear relationships that may not hold in all economic contexts

Future Work

- Investigate the impact of exchange rate policies on different industry sectors

- Analyze the role of technological innovation in exchange rate effects

- Explore optimal exchange rate fluctuation ranges using more complex models

Paper Details

PDF Preview

Similar Papers

Found 5 papersFinancial Inclusion and Monetary Policy: A Study on the Relationship between Financial Inclusion and Effectiveness of Monetary Policy in Developing Countries

Gautam Kumar Biswas, Faruque Ahamed

Comments (0)