Summary

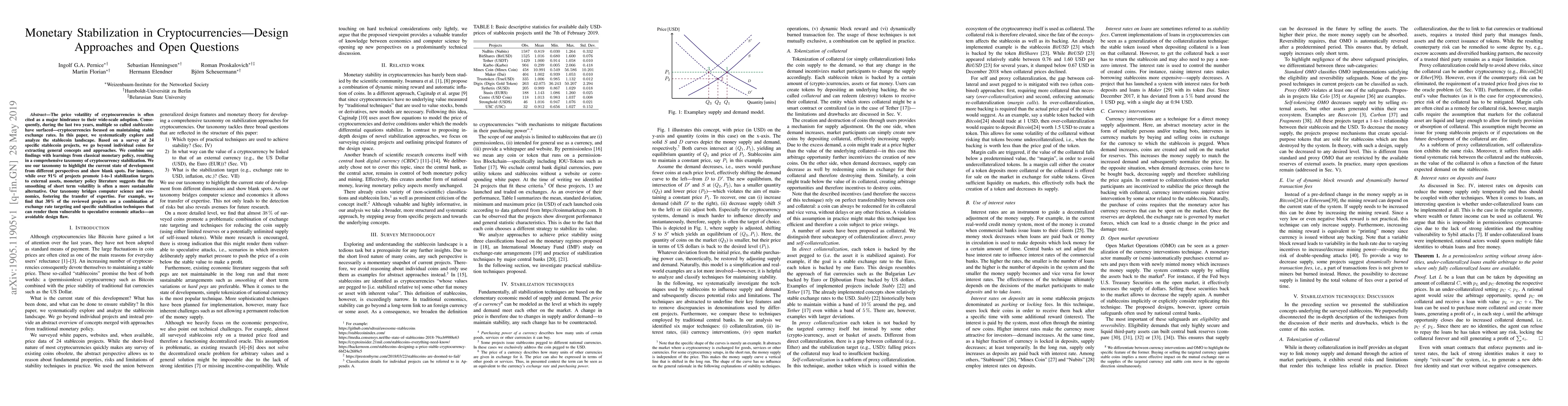

The price volatility of cryptocurrencies is often cited as a major hindrance to their wide-scale adoption. Consequently, during the last two years, multiple so called stablecoins have surfaced---cryptocurrencies focused on maintaining stable exchange rates. In this paper, we systematically explore and analyze the stablecoin landscape. Based on a survey of 24 specific stablecoin projects, we go beyond individual coins for extracting general concepts and approaches. We combine our findings with learnings from classical monetary policy, resulting in a comprehensive taxonomy of cryptocurrency stabilization. We use our taxonomy to highlight the current state of development from different perspectives and show blank spots. For instance, while over 91% of projects promote 1-to-1 stabilization targets to external assets, monetary policy literature suggests that the smoothing of short term volatility is often a more sustainable alternative. Our taxonomy bridges computer science and economics, fostering the transfer of expertise. For example, we find that 38% of the reviewed projects use a combination of exchange rate targeting and specific stabilization techniques that can render them vulnerable to speculative economic attacks - an avoidable design flaw.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersExamining the Effect of Monetary Policy and Monetary Policy Uncertainty on Cryptocurrencies Market

Mohammadreza Mahmoudi

Optimization approaches for the design and operation of open-loop shallow geothermal systems

S. Halilovic, F. Böttcher, K. Zosseder et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)