Summary

We consider the problem of pricing path-dependent options on a basket of underlying assets using simulations. As an example we develop our studies using Asian options. Asian options are derivative contracts in which the underlying variable is the average price of given assets sampled over a period of time. Due to this structure, Asian options display a lower volatility and are therefore cheaper than their standard European counterparts. This paper is a survey of some recent enhancements to improve efficiency when pricing Asian options by Monte Carlo simulation in the Black-Scholes model. We analyze the dynamics with constant and time-dependent volatilities of the underlying asset returns. We present a comparison between the precision of the standard Monte Carlo method (MC) and the stratified Latin Hypercube Sampling (LHS). In particular, we discuss the use of low-discrepancy sequences, also known as Quasi-Monte Carlo method (QMC), and a randomized version of these sequences, known as Randomized Quasi Monte Carlo (RQMC). The latter has proven to be a useful variance reduction technique for both problems of up to 20 dimensions and for very high dimensions. Moreover, we present and test a new path generation approach based on a Kronecker product approximation (KPA) in the case of time-dependent volatilities. KPA proves to be a fast generation technique and reduces the computational cost of the simulation procedure.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

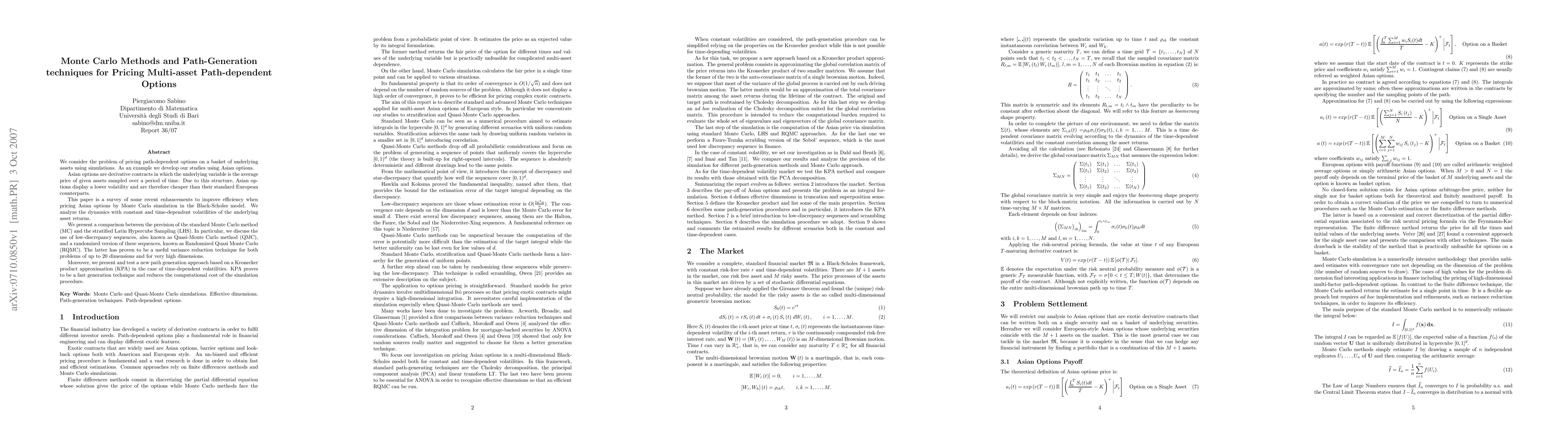

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersQuasi-Monte Carlo for Efficient Fourier Pricing of Multi-Asset Options

Raúl Tempone, Christian Bayer, Chiheb Ben Hammouda et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)