Summary

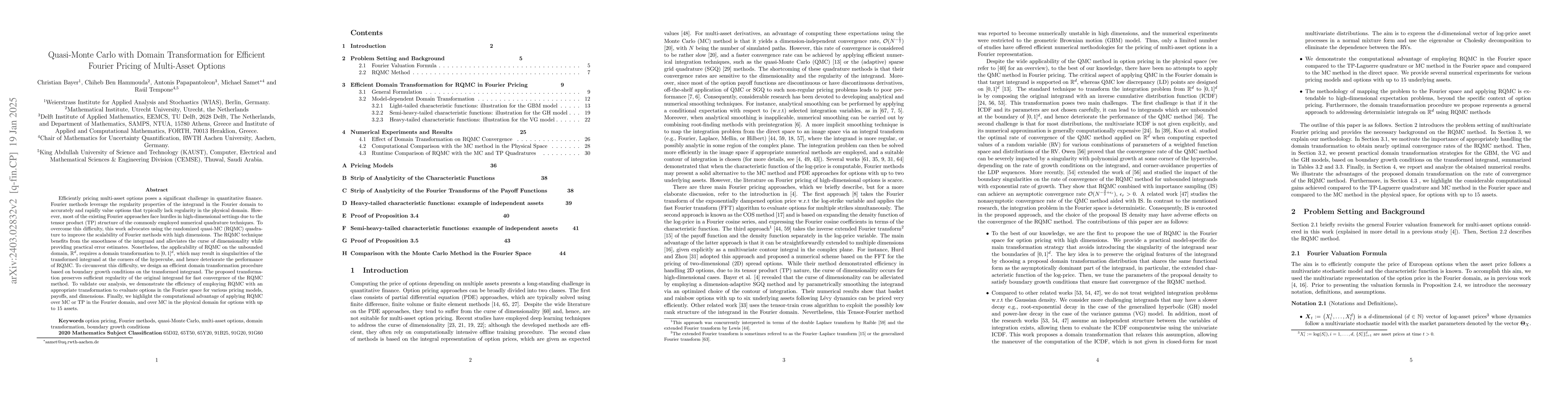

Efficiently pricing multi-asset options poses a significant challenge in quantitative finance. The Monte Carlo (MC) method remains the prevalent choice for pricing engines; however, its slow convergence rate impedes its practical application. Fourier methods leverage the knowledge of the characteristic function to accurately and rapidly value options with up to two assets. Nevertheless, they face hurdles in the high-dimensional settings due to the tensor product (TP) structure of commonly employed quadrature techniques. This work advocates using the randomized quasi-MC (RQMC) quadrature to improve the scalability of Fourier methods with high dimensions. The RQMC technique benefits from the smoothness of the integrand and alleviates the curse of dimensionality while providing practical error estimates. Nonetheless, the applicability of RQMC on the unbounded domain, $\mathbb{R}^d$, requires a domain transformation to $[0,1]^d$, which may result in singularities of the transformed integrand at the corners of the hypercube, and deteriorate the rate of convergence of RQMC. To circumvent this difficulty, we design an efficient domain transformation procedure based on the derived boundary growth conditions of the integrand. This transformation preserves the sufficient regularity of the integrand and hence improves the rate of convergence of RQMC. To validate this analysis, we demonstrate the efficiency of employing RQMC with an appropriate transformation to evaluate options in the Fourier space for various pricing models, payoffs, and dimensions. Finally, we highlight the computational advantage of applying RQMC over MC or TP in the Fourier domain, and over MC in the physical domain for options with up to 15 assets.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Similar Papers

Found 4 papersA highly efficient tensor network algorithm for multi-asset Fourier options pricing

Nicola Pancotti, Michael Kastoryano

Tensor train representations of Greeks for Fourier-based pricing of multi-asset options

Tsuyoshi Okubo, Koichi Miyamoto, Rihito Sakurai

No citations found for this paper.

Comments (0)