Summary

We design multi-horizon forecasting models for limit order book (LOB) data by using deep learning techniques. Unlike standard structures where a single prediction is made, we adopt encoder-decoder models with sequence-to-sequence and Attention mechanisms to generate a forecasting path. Our methods achieve comparable performance to state-of-art algorithms at short prediction horizons. Importantly, they outperform when generating predictions over long horizons by leveraging the multi-horizon setup. Given that encoder-decoder models rely on recurrent neural layers, they generally suffer from slow training processes. To remedy this, we experiment with utilising novel hardware, so-called Intelligent Processing Units (IPUs) produced by Graphcore. IPUs are specifically designed for machine intelligence workload with the aim to speed up the computation process. We show that in our setup this leads to significantly faster training times when compared to training models with GPUs.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

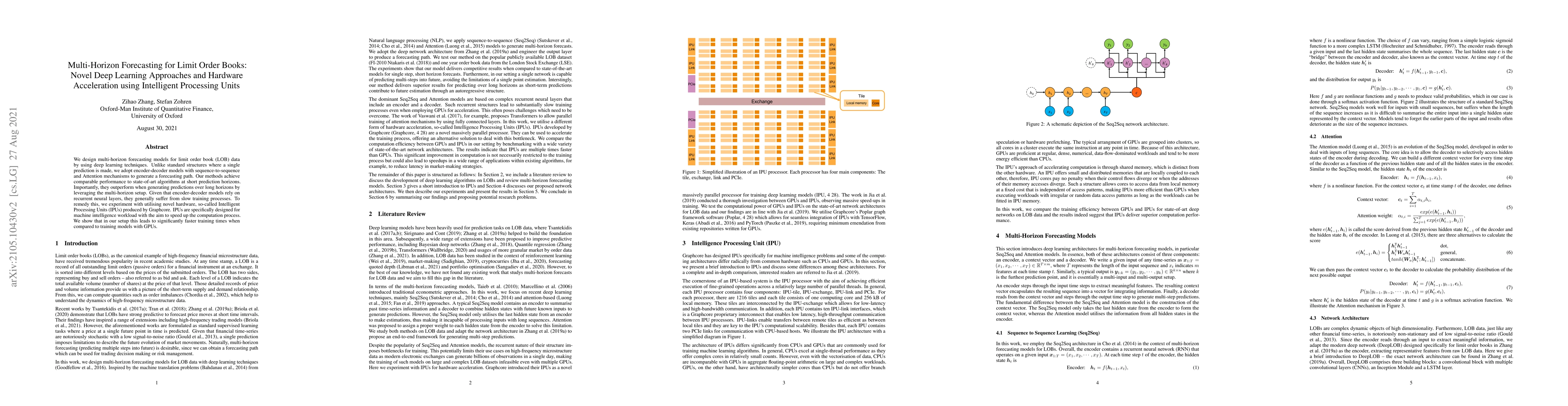

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)