Summary

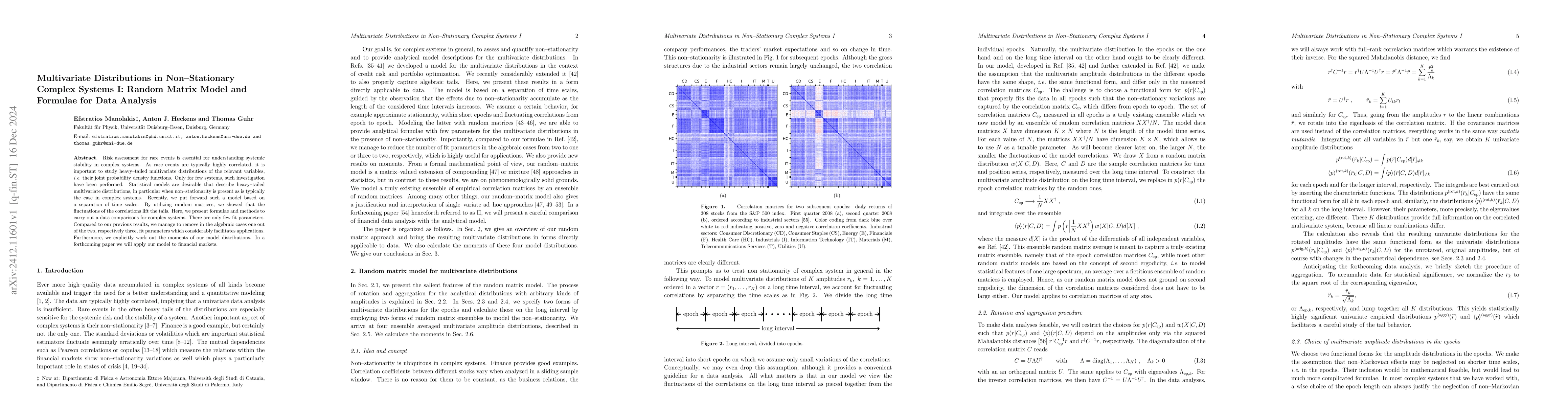

Risk assessment for rare events is essential for understanding systemic stability in complex systems. As rare events are typically highly correlated, it is important to study heavy-tailed multivariate distributions of the relevant variables, i.e. their joint probability density functions. Only for few systems, such investigation have been performed. Statistical models are desirable that describe heavy-tailed multivariate distributions, in particular when non-stationarity is present as is typically the case in complex systems. Recently, we put forward such a model based on a separation of time scales. By utilizing random matrices, we showed that the fluctuations of the correlations lift the tails. Here, we present formulae and methods to carry out a data comparisons for complex systems. There are only few fit parameters. Compared to our previous results, we manage to remove in the algebraic cases one out of the two, respectively three, fit parameters which considerably facilitates applications. Furthermore, we explicitly work out the moments of our model distributions. In a forthcoming paper we will apply our model to financial markets.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMultivariate Distributions in Non-Stationary Complex Systems II: Empirical Results for Correlated Stock Markets

Thomas Guhr, Anton J. Heckens, Efstratios Manolakis et al.

Kernel-based Joint Independence Tests for Multivariate Stationary and Non-stationary Time Series

Mauricio Barahona, Zhaolu Liu, Robert L. Peach et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)