Summary

Multivariate Distributions are needed to capture the correlation structure of complex systems. In previous works, we developed a Random Matrix Model for such correlated multivariate joint probability density functions that accounts for the non-stationarity typically found in complex systems. Here, we apply these results to the returns measured in correlated stock markets. Only the knowledge of the multivariate return distributions allows for a full-fledged risk assessment. We analyze intraday data of 479 US stocks included in the S&P500 index during the trading year of 2014. We focus particularly on the tails which are algebraic and heavy. The non-stationary fluctuations of the correlations make the tails heavier. With the few-parameter formulae of our Random Matrix Model we can describe and quantify how the empirical distributions change for varying time resolution and in the presence of non-stationarity.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

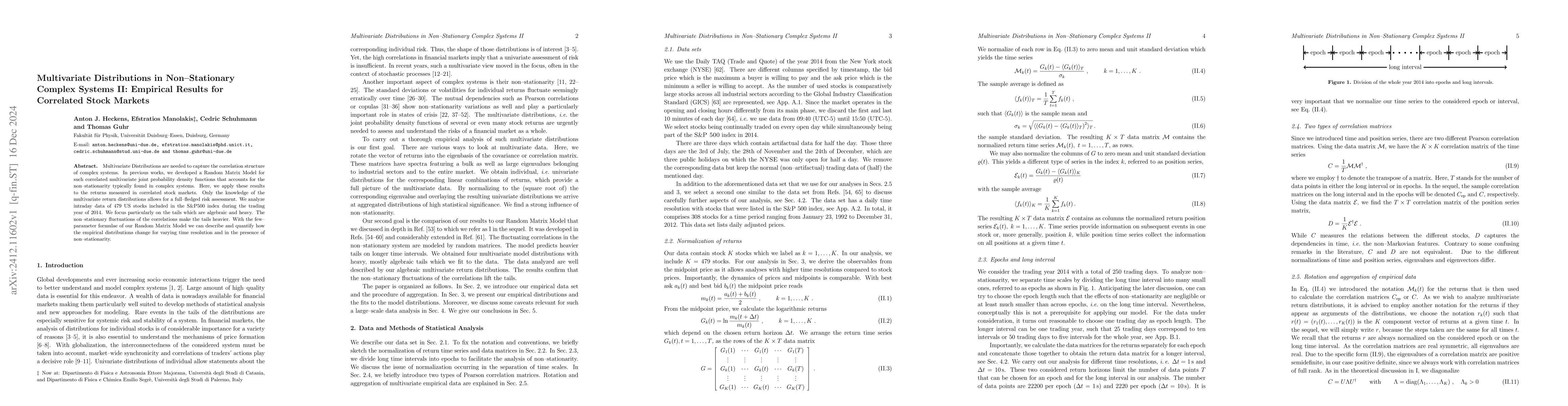

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)