Authors

Summary

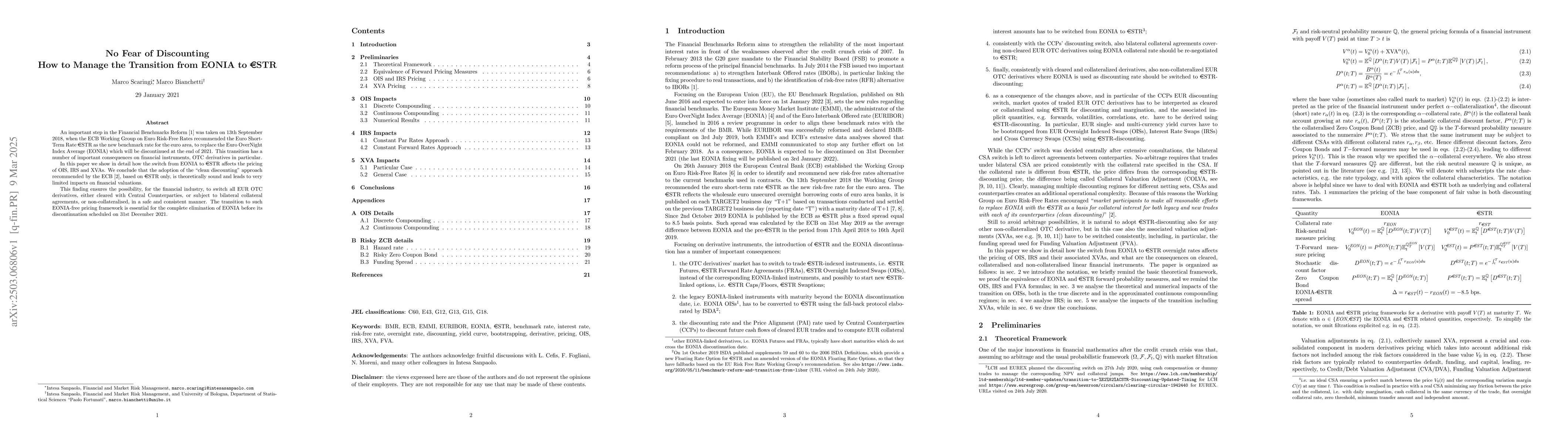

An important step in the Financial Benchmarks Reform was taken on 13th September 2018, when the ECB Working Group on Euro Risk-Free Rates recommended the Euro Short-Term Rate ESTR as the new benchmark rate for the euro area, to replace the Euro OverNight Index Average (EONIA) which will be discontinued at the end of 2021. This transition has a number of important consequences on financial instruments, OTC derivatives in particular. In this paper we show in detail how the switch from EONIA to ESTR affects the pricing of OIS, IRS and XVAs. We conclude that the adoption of the "clean discounting" approach recommended by the the ECB, based on ESTR only, is theoretically sound and leads to very limited impacts on financial valuations. This finding ensures the possibility, for the financial industry, to switch all EUR OTC derivatives, either cleared with Central Counterparties, or subject to bilateral collateral agreements, or non-collateralised, in a safe and consistent manner. The transition to such EONIA-free pricing framework is essential for the complete elimination of EONIA before its discontinuation scheduled on 31st December 2021.

AI Key Findings

Generated Jun 10, 2025

Methodology

The paper employs theoretical analysis and numerical results to examine the transition from EONIA to ESTR, focusing on OIS, IRS, and XVAs pricing under the new benchmark.

Key Results

- The transition to ESTR using the 'clean discounting' approach has limited impacts on financial valuations, ensuring a safe switch for all EUR OTC derivatives.

- The constant spread of 8.5 bps between ESTR and EONIA overnight rates propagates to par OIS rates in a non-trivial way, but the residual distortion is small, depending on the level and shape of market OIS spreads.

- The transition affects both par IRS rates and implied EURIBOR forward rates in a negligible way, allowing for a safe switch in multi-curve bootstrapping of EURIBOR curves and IRS pricing from EONIA to ESTR.

Significance

This research is crucial for the financial industry as it provides a theoretically sound and practical framework for transitioning from EONIA to ESTR, ensuring the complete elimination of EONIA before its discontinuation in 2021.

Technical Contribution

The paper presents a detailed analysis of the transition's effects on OIS, IRS, and XVAs, validating the ECB's 'clean discounting' approach based on ESTR only.

Novelty

This work distinguishes itself by providing comprehensive analysis and numerical results on the transition's impact, ensuring a safe and consistent switch for the financial industry.

Limitations

- The analysis primarily focuses on linear IR derivatives, and further research is needed for non-linear IR derivatives.

- The study assumes constant funding rates, which might not hold under all market conditions.

Future Work

- Explore the impact of the EONIA-to-ESTR transition on non-linear IR derivatives.

- Investigate the implications of the transition under varying funding rate assumptions.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSports or no sports? How to manage the young arrhythmia patient.

Ertugrul, Ilger, Blom, Nico A, European Reference Network for Rare Diseases of the Heart (ERN GUARDHEART)

How to Manage My Data? With Machine--Interpretable GDPR Rights!

Harshvardhan J. Pandit, Paul Ryan, Georg P. Krog et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)