Summary

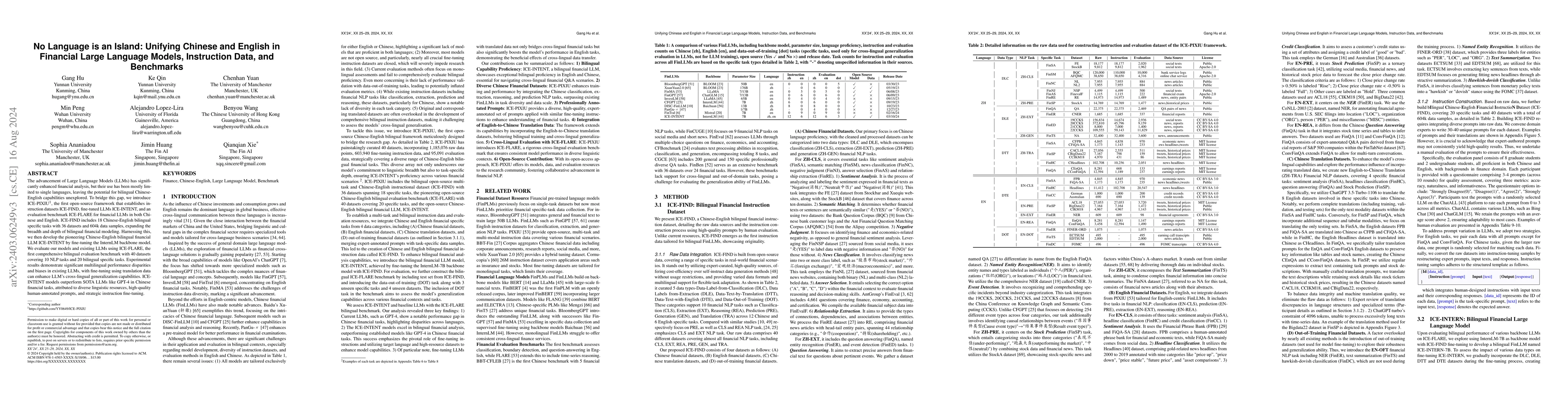

While the progression of Large Language Models (LLMs) has notably propelled financial analysis, their application has largely been confined to singular language realms, leaving untapped the potential of bilingual Chinese-English capacity. To bridge this chasm, we introduce ICE-PIXIU, seamlessly amalgamating the ICE-INTENT model and ICE-FLARE benchmark for bilingual financial analysis. ICE-PIXIU uniquely integrates a spectrum of Chinese tasks, alongside translated and original English datasets, enriching the breadth and depth of bilingual financial modeling. It provides unrestricted access to diverse model variants, a substantial compilation of diverse cross-lingual and multi-modal instruction data, and an evaluation benchmark with expert annotations, comprising 10 NLP tasks, 20 bilingual specific tasks, totaling 95k datasets. Our thorough evaluation emphasizes the advantages of incorporating these bilingual datasets, especially in translation tasks and utilizing original English data, enhancing both linguistic flexibility and analytical acuity in financial contexts. Notably, ICE-INTENT distinguishes itself by showcasing significant enhancements over conventional LLMs and existing financial LLMs in bilingual milieus, underscoring the profound impact of robust bilingual data on the accuracy and efficacy of financial NLP.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAn Empirical Study of Instruction-tuning Large Language Models in Chinese

Xu Zhang, Qingyi Si, Zheng Lin et al.

Panda LLM: Training Data and Evaluation for Open-Sourced Chinese Instruction-Following Large Language Models

Fangkai Jiao, Bosheng Ding, Tianze Luo et al.

SNFinLLM: Systematic and Nuanced Financial Domain Adaptation of Chinese Large Language Models

Shujuan Zhao, Lingfeng Qiao, Kangyang Luo et al.

CFGPT: Chinese Financial Assistant with Large Language Model

Yuxuan Bian, Changjun Jiang, Jiangtong Li et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)