Authors

Summary

We investigate expected utility maximization problems from the terminal liquidation value in continuous time in markets with transaction costs and one fixed consistent price system, where a non-concave utility function is defined on the positive half real line. The sufficient conditions are given by the convex conjugate of the utility function, then the existence of the optimizer is proved by a maximizing sequence. Finally, we show that the value function of the envelope of the utility function and the concave envelope of the value function are coincide.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

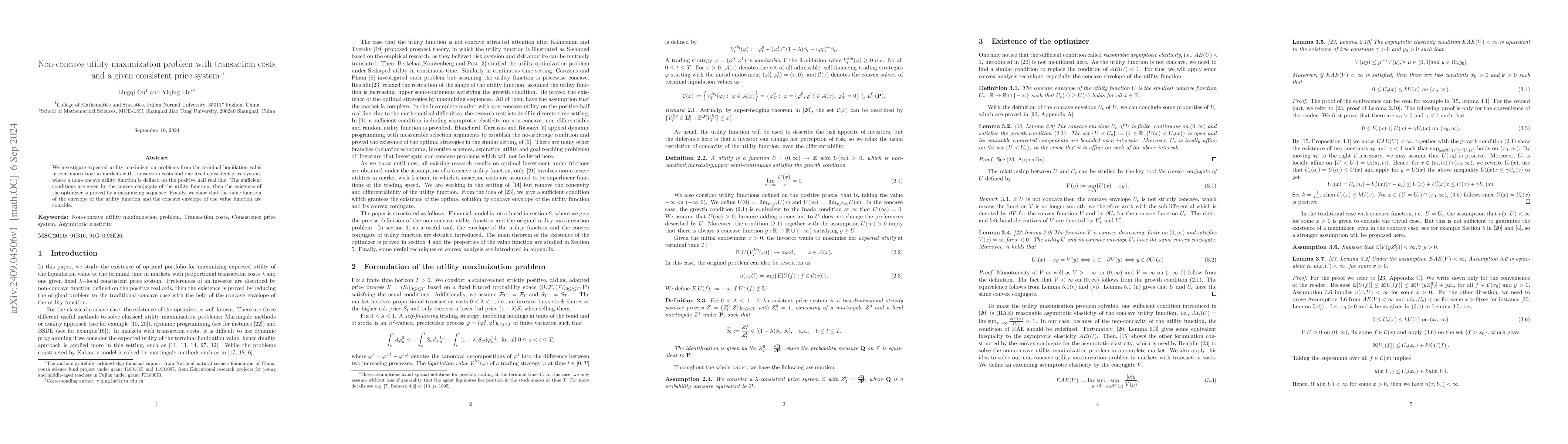

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)