Summary

This paper discusses the num\'eraire-based utility maximization problem in markets with proportional transaction costs. In particular, the investor is required to liquidate all her position in stock at the terminal time. We first observe the stability of the primal and dual value functions as well as the convergence of the primal and dual optimizers when perturbations occur on the utility function and on the physical probability. We then study the properties of the optimal dual process (ODP), that is, a process from the dual domain that induces the optimality of the dual problem. When the market is driven by a continuous process, we construct the ODP for the problem in the limiting market by a sequence of ODPs corresponding to the problems with small misspecificated parameters. Moreover, we prove that this limiting ODP defines a shadow price.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

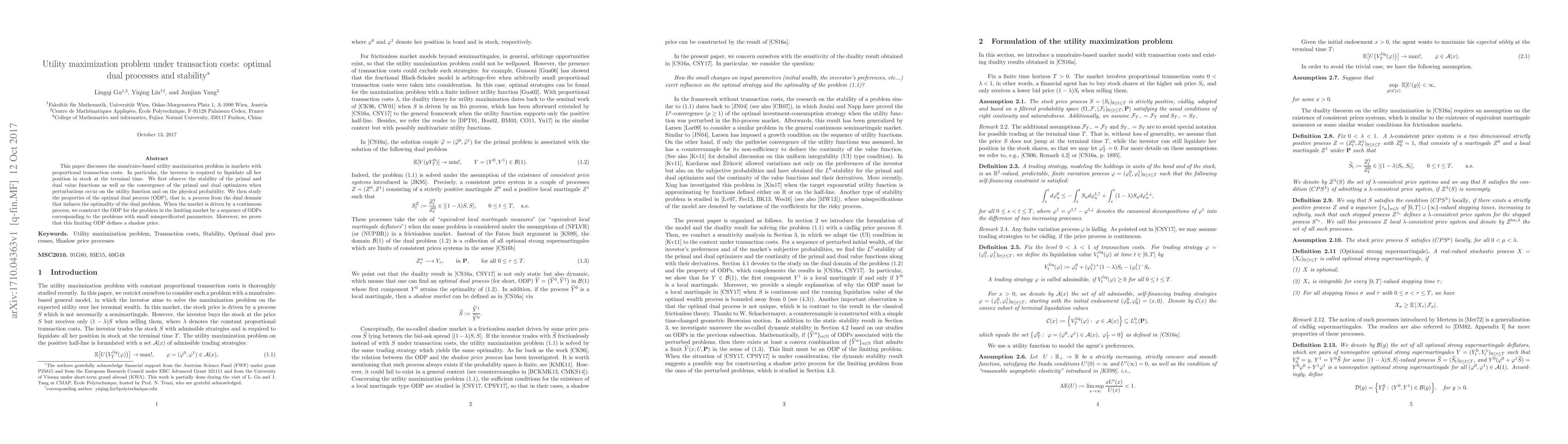

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

No citations found for this paper.

Comments (0)