Authors

Summary

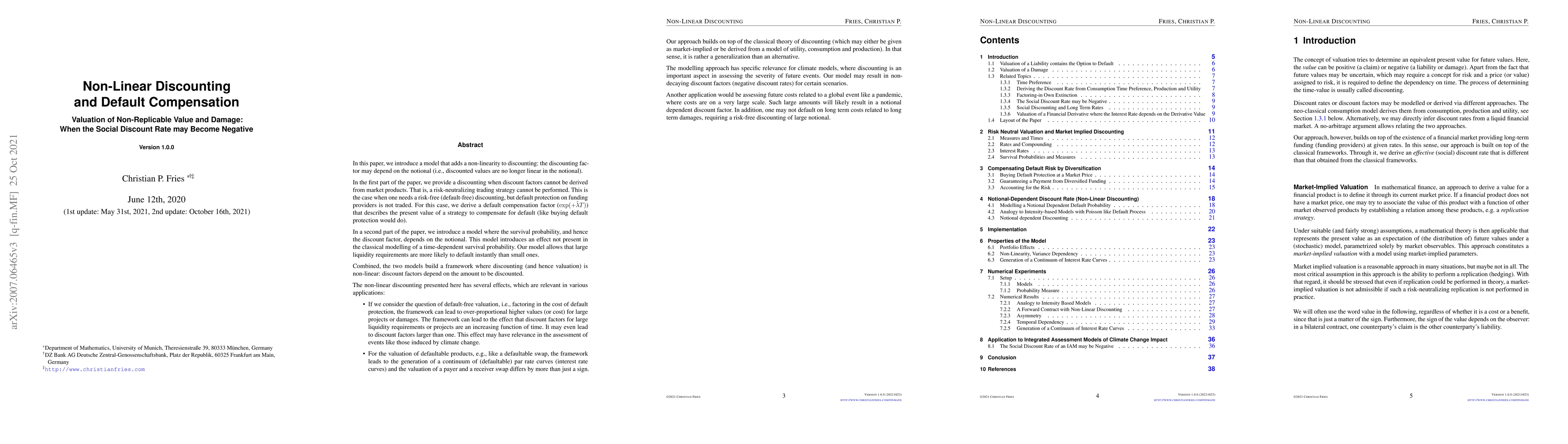

In this paper, we introduce a model that adds a non-linearity to discounting: the discounting factor may depend on the notional (i.e., discounted values are no longer linear in the notional). In the first part of the paper, we provide a discounting when discount factors cannot be derived from market products. That is, a risk-neutralising trading strategy cannot be performed. This is the case when one needs a risk-free (default-free) discounting, but default protection on funding providers is not traded. For this case, we derive a default compensation factor that describes the present value of a strategy to compensate for default (like buying default protection would do). In a second part of the paper, we introduce a model where the survival probability, and hence the discount factor, depends on the notional. This model introduces an effect not present in the classical modelling of a time-dependent survival probability. Our model allows that large liquidity requirements are more likely to default instantly than small ones. Combined, the two models build a framework where discounting (and hence valuation) is non-linear: discount factors depend on the amount to be discounted. Our approach builds on top of the classical theory of discounting (which may either be given as market-implied or be derived from a model of utility, consumption and production). In that sense, it is rather a generalisation than an alternative. The modelling approach has specific relevance for climate models, where discounting is an important aspect in assessing the severity of future events. Our model may result in non-decaying discount factors (negative discount rates) for certain scenarios.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersStochastic dynamic programming with non-linear discounting

Nicole Bäuerle, Anna Jaśkiewicz, Andrzej S. Nowak

Identifying Non-Replicable Social Science Studies with Language Models

Moa Johansson, Denitsa Saynova, Bastiaan Bruinsma et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)