Summary

The well-known theorem of Dybvig, Ingersoll and Ross shows that the long zero-coupon rate can never fall. This result, which, although undoubtedly correct, has been regarded by many as surprising, stems from the implicit assumption that the long-term discount function has an exponential tail. We revisit the problem in the setting of modern interest rate theory, and show that if the long "simple" interest rate (or Libor rate) is finite, then this rate (unlike the zero-coupon rate) acts viably as a state variable, the value of which can fluctuate randomly in line with other economic indicators. New interest rate models are constructed, under this hypothesis and certain generalizations thereof, that illustrate explicitly the good asymptotic behaviour of the resulting discount bond systems. The conditions necessary for the existence of such "hyperbolic" and "generalized hyperbolic" long rates are those of so-called social discounting, which allow for long-term cash flows to be treated as broadly "just as important" as those of the short or medium term. As a consequence, we are able to provide a consistent arbitrage-free valuation framework for the cost-benefit analysis and risk management of long-term social projects, such as those associated with sustainable energy, resource conservation, and climate change.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

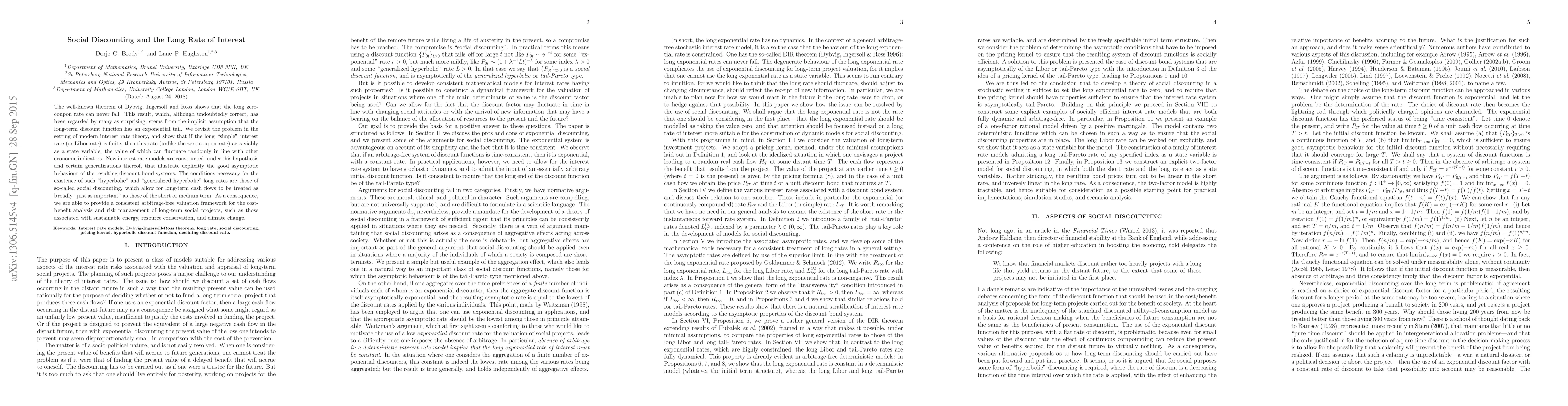

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)