Authors

Summary

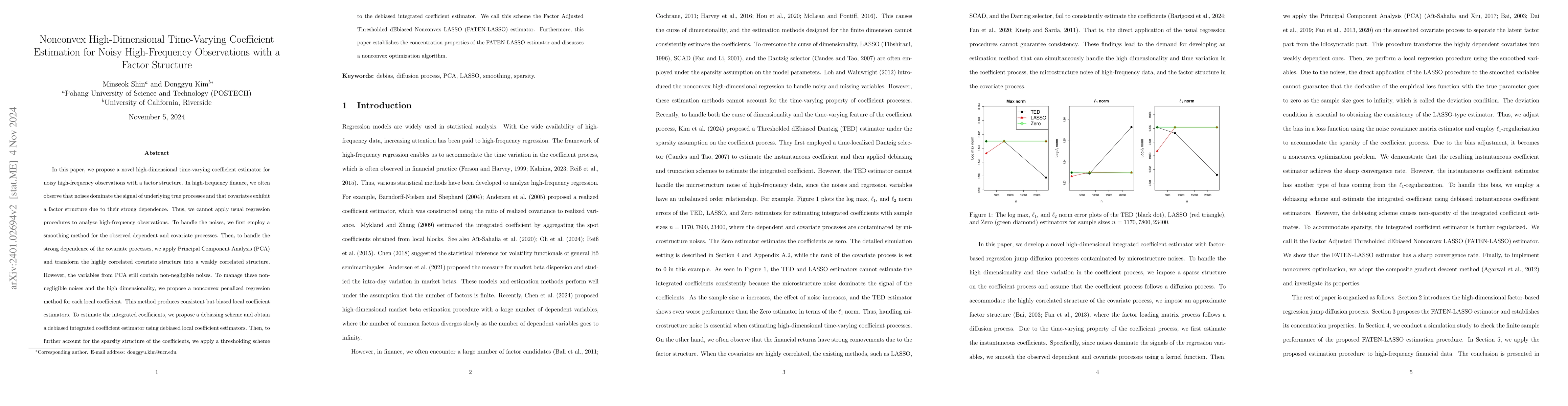

In this paper, we propose a novel high-dimensional time-varying coefficient estimator for noisy high-frequency observations. In high-frequency finance, we often observe that noises dominate a signal of an underlying true process. Thus, we cannot apply usual regression procedures to analyze noisy high-frequency observations. To handle this issue, we first employ a smoothing method for the observed variables. However, the smoothed variables still contain non-negligible noises. To manage these non-negligible noises and the high dimensionality, we propose a nonconvex penalized regression method for each local coefficient. This method produces consistent but biased local coefficient estimators. To estimate the integrated coefficients, we propose a debiasing scheme and obtain a debiased integrated coefficient estimator using debiased local coefficient estimators. Then, to further account for the sparsity structure of the coefficients, we apply a thresholding scheme to the debiased integrated coefficient estimator. We call this scheme the Thresholded dEbiased Nonconvex LASSO (TEN-LASSO) estimator. Furthermore, this paper establishes the concentration properties of the TEN-LASSO estimator and discusses a nonconvex optimization algorithm.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Similar Papers

Found 4 papersRobust High-Dimensional Time-Varying Coefficient Estimation

Donggyu Kim, Minseok Shin

High-Dimensional Time-Varying Coefficient Estimation

Donggyu Kim, Minseok Shin, Minseog Oh

No citations found for this paper.

Comments (0)