Summary

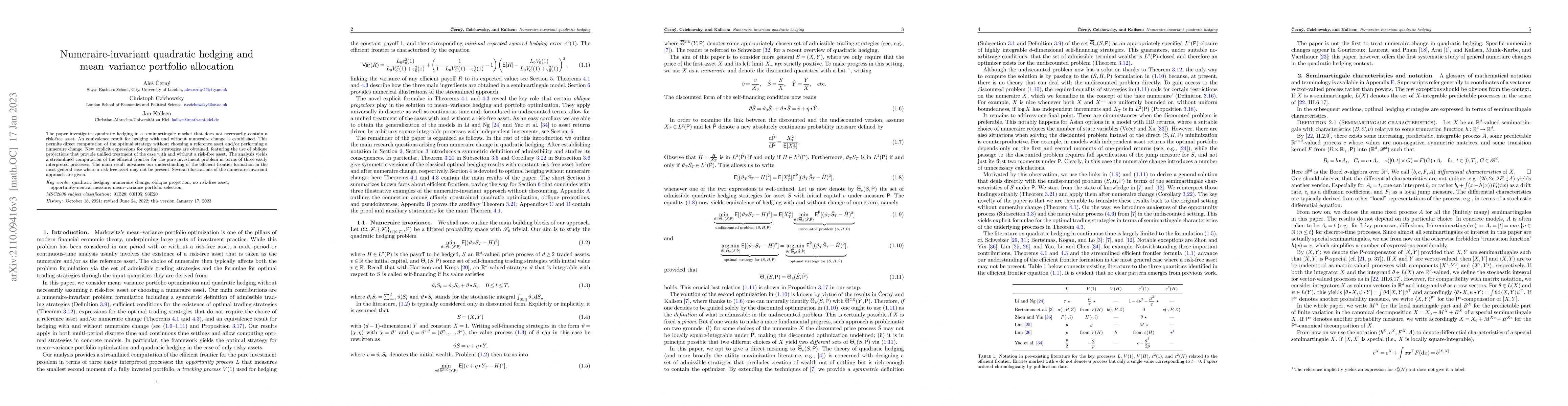

The paper investigates quadratic hedging in a semimartingale market that does not necessarily contain a risk-free asset. An equivalence result for hedging with and without numeraire change is established (Proposition 3.16). This permits direct computation of the optimal strategy without choosing a reference asset and/or performing a numeraire change (Theorem 4.1). New explicit expressions for optimal strategies are obtained, featuring the use of oblique projections that provide unified treatment of the case with and without a risk-free asset (Theorem 4.3). The analysis yields a streamlined computation of the efficient frontier for the pure investment problem in terms of three easily interpreted processes (Equation~1.1). The main result advances our understanding of the efficient frontier formation in the most general case where a risk-free asset may not be present. Several illustrations of the numeraire-invariant approach are given.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)