Authors

Summary

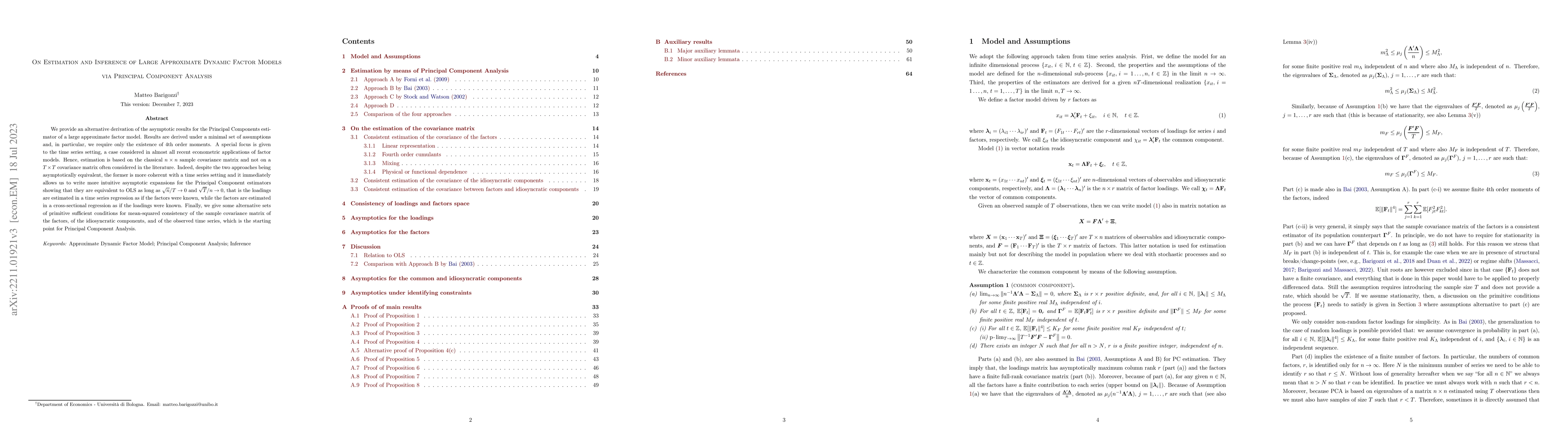

We provide an alternative derivation of the asymptotic results for the Principal Components estimator of a large approximate factor model. Results are derived under a minimal set of assumptions and, in particular, we require only the existence of 4th order moments. A special focus is given to the time series setting, a case considered in almost all recent econometric applications of factor models. Hence, estimation is based on the classical $n\times n$ sample covariance matrix and not on a $T\times T$ covariance matrix often considered in the literature. Indeed, despite the two approaches being asymptotically equivalent, the former is more coherent with a time series setting and it immediately allows us to write more intuitive asymptotic expansions for the Principal Component estimators showing that they are equivalent to OLS as long as $\sqrt n/T\to 0$ and $\sqrt T/n\to 0$, that is the loadings are estimated in a time series regression as if the factors were known, while the factors are estimated in a cross-sectional regression as if the loadings were known. Finally, we give some alternative sets of primitive sufficient conditions for mean-squared consistency of the sample covariance matrix of the factors, of the idiosyncratic components, and of the observed time series, which is the starting point for Principal Component Analysis.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersQuasi Maximum Likelihood Estimation and Inference of Large Approximate Dynamic Factor Models via the EM algorithm

Matteo Barigozzi, Matteo Luciani

Generalized functional dynamic principal component analysis

Sophie Dabo-Niang, Issa-Mbenard Dabo, Tzung Hsuen Khoo et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)