Authors

Summary

This paper studies Quasi Maximum Likelihood estimation of Dynamic Factor Models for large panels of time series. Specifically, we consider the case in which the autocorrelation of the factors is explicitly accounted for, and therefore the model has a state-space form. Estimation of the factors and their loadings is implemented through the Expectation Maximization (EM) algorithm, jointly with the Kalman smoother.~We prove that as both the dimension of the panel $n$ and the sample size $T$ diverge to infinity, up to logarithmic terms: (i) the estimated loadings are $\sqrt T$-consistent and asymptotically normal if $\sqrt T/n\to 0$; (ii) the estimated factors are $\sqrt n$-consistent and asymptotically normal if $\sqrt n/T\to 0$; (iii) the estimated common component is $\min(\sqrt n,\sqrt T)$-consistent and asymptotically normal regardless of the relative rate of divergence of $n$ and $T$. Although the model is estimated as if the idiosyncratic terms were cross-sectionally and serially uncorrelated and normally distributed, we show that these mis-specifications do not affect consistency. Moreover, the estimated loadings are asymptotically as efficient as those obtained with the Principal Components estimator, while the estimated factors are more efficient if the idiosyncratic covariance is sparse enough.~We then propose robust estimators of the asymptotic covariances, which can be used to conduct inference on the loadings and to compute confidence intervals for the factors and common components. Finally, we study the performance of our estimators and we compare them with the traditional Principal Components approach through MonteCarlo simulations and analysis of US macroeconomic data.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

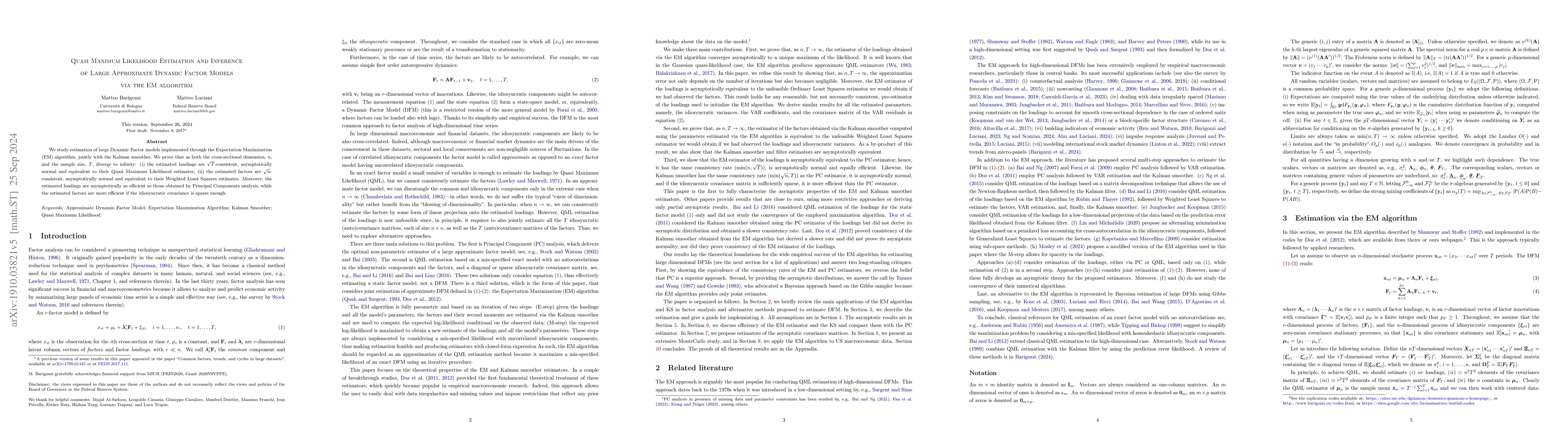

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersQuasi maximum likelihood estimation of high-dimensional approximate dynamic matrix factor models via the EM algorithm

Matteo Barigozzi, Luca Trapin

| Title | Authors | Year | Actions |

|---|

Comments (0)