Summary

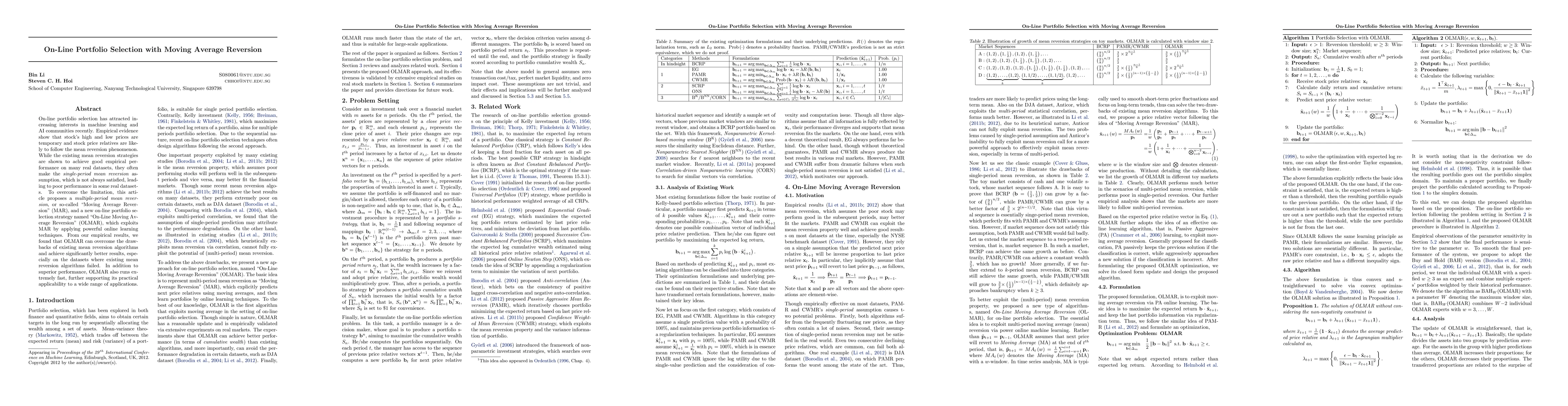

On-line portfolio selection has attracted increasing interests in machine learning and AI communities recently. Empirical evidences show that stock's high and low prices are temporary and stock price relatives are likely to follow the mean reversion phenomenon. While the existing mean reversion strategies are shown to achieve good empirical performance on many real datasets, they often make the single-period mean reversion assumption, which is not always satisfied in some real datasets, leading to poor performance when the assumption does not hold. To overcome the limitation, this article proposes a multiple-period mean reversion, or so-called Moving Average Reversion (MAR), and a new on-line portfolio selection strategy named "On-Line Moving Average Reversion" (OLMAR), which exploits MAR by applying powerful online learning techniques. From our empirical results, we found that OLMAR can overcome the drawback of existing mean reversion algorithms and achieve significantly better results, especially on the datasets where the existing mean reversion algorithms failed. In addition to superior trading performance, OLMAR also runs extremely fast, further supporting its practical applicability to a wide range of applications.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRobust portfolio selection under Recovery Average Value at Risk

Cosimo Munari, Stefan Weber, Justin Plückebaum

Generalized Exponentiated Gradient Algorithms and Their Application to On-Line Portfolio Selection

Andrzej Cichocki, Sergio Cruces, Auxiliadora Sarmiento et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)