Authors

Summary

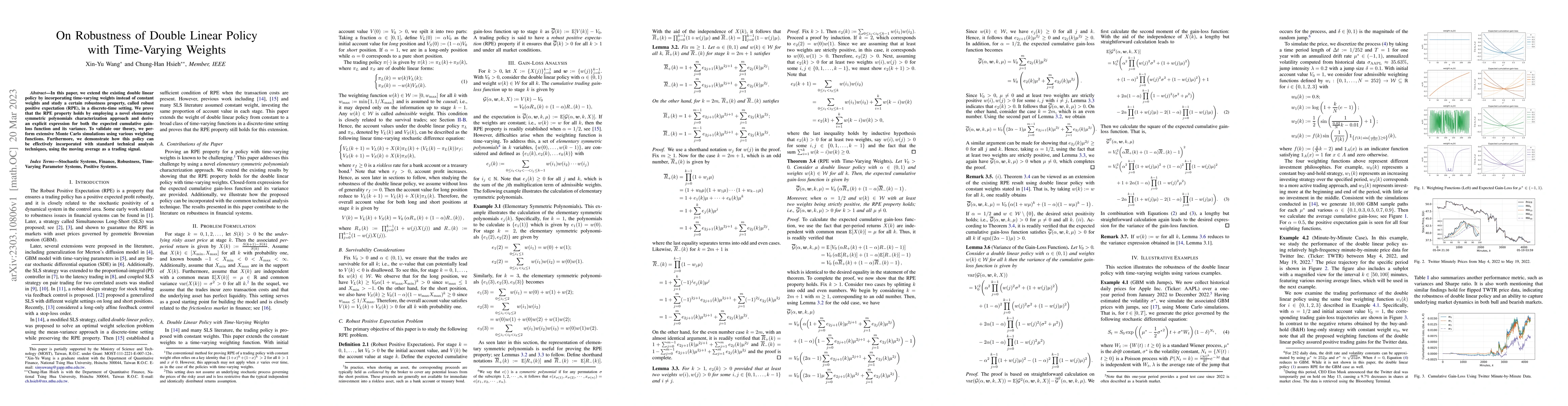

In this paper, we extend the existing double linear policy by incorporating time-varying weights instead of constant weights and study a certain robustness property, called robust positive expectation (RPE), in a discrete-time setting. We prove that the RPE property holds by employing a novel elementary symmetric polynomials characterization approach and derive an explicit expression for both the expected cumulative gain-loss function and its variance. To validate our theory, we perform extensive Monte Carlo simulations using various weighting functions. Furthermore, we demonstrate how this policy can be effectively incorporated with standard technical analysis techniques, using the moving average as a trading signal.

AI Key Findings

Generated Sep 06, 2025

Methodology

A discrete-time extension of the double linear trading policy with time-varying weights is presented.

Key Results

- The RPE property is preserved in the extended policy.

- An explicit expression for the expected cumulative gain-loss function and its variance are derived.

- Monte Carlo simulations validate the theoretical results.

Significance

This research extends existing double linear trading policies to incorporate time-varying weights, providing a more robust and flexible framework for stock trading.

Technical Contribution

A novel extension of double linear trading policies that incorporates time-varying weights, preserving the RPE property and providing a more robust framework for stock trading.

Novelty

The use of elementary symmetric polynomials to derive the extended policy's performance metrics and the incorporation of technical analysis indicators as weighting functions.

Limitations

- The policy assumes a specific model of price dynamics.

- Transaction costs are not explicitly considered in the theoretical analysis.

Future Work

- Expanding the policy to accommodate multiple assets.

- Investigating the impact of serial-correlated returns on the policy's performance.

- Assessing the practicality of the policy with transaction costs

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSingular flows with time-varying weights

José A. Carrillo, Immanuel Ben Porat, Pierre-Emmanuel Jabin

Signal Temporal Logic Planning with Time-Varying Robustness

Jun Liu, Thanin Quartz, Yating Yuan

| Title | Authors | Year | Actions |

|---|

Comments (0)