Summary

In the context of jump-diffusion market models we construct examples that satisfy the weaker no-arbitrage condition of NA1 (NUPBR), but not NFLVR. We show that in these examples the only candidate for the density process of an equivalent local martingale measure is a supermartingale that is not a martingale, not even a local martingale. This candidate is given by the supermartingale deflator resulting from the inverse of the discounted growth optimal portfolio. In particular, we con- sider an example with constraints on the portfolio that go beyond the standard ones for admissibility.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

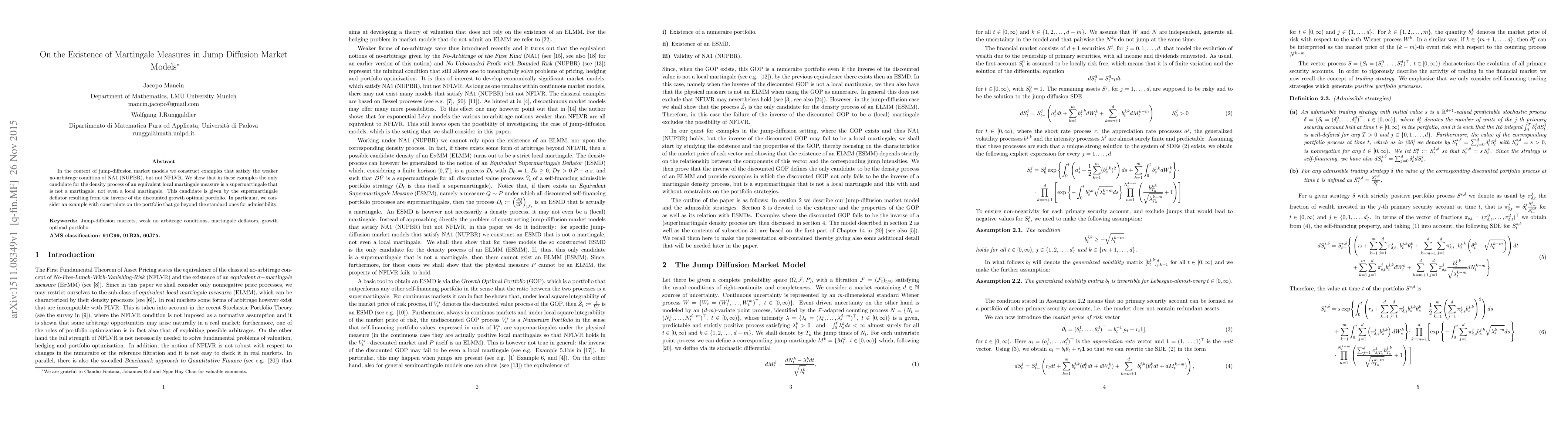

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)