Summary

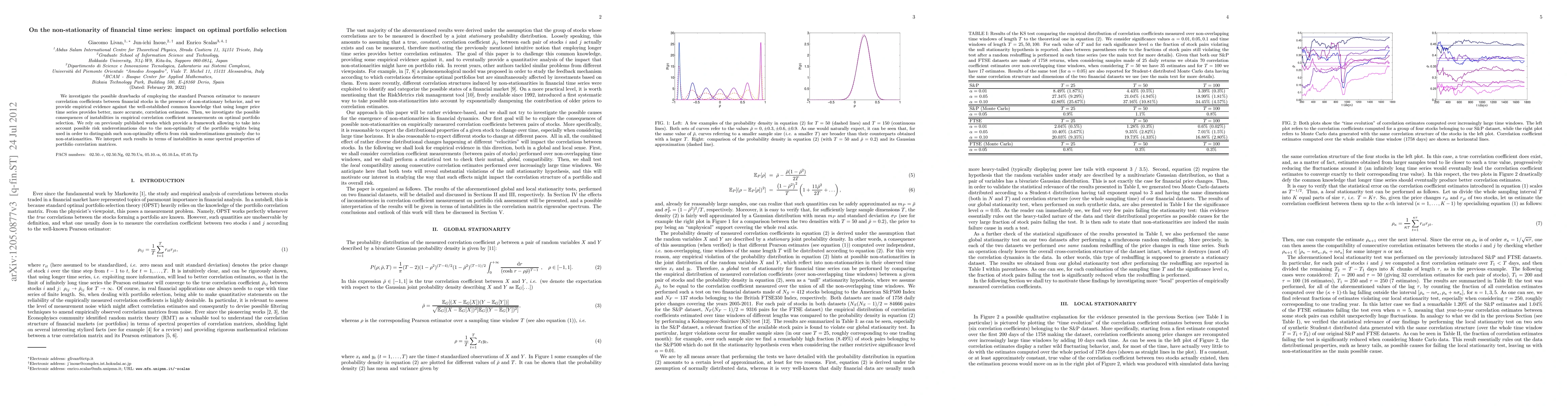

We investigate the possible drawbacks of employing the standard Pearson estimator to measure correlation coefficients between financial stocks in the presence of non-stationary behavior, and we provide empirical evidence against the well-established common knowledge that using longer price time series provides better, more accurate, correlation estimates. Then, we investigate the possible consequences of instabilities in empirical correlation coefficient measurements on optimal portfolio selection. We rely on previously published works which provide a framework allowing to take into account possible risk underestimations due to the non-optimality of the portfolio weights being used in order to distinguish such non-optimality effects from risk underestimations genuinely due to non-stationarities. We interpret such results in terms of instabilities in some spectral properties of portfolio correlation matrices.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTimeBridge: Non-Stationarity Matters for Long-term Time Series Forecasting

Yifan Hu, Tao Dai, Peiyuan Liu et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)