Summary

Constant Proportion Portfolio Insurance (CPPI) is an investment strategy designed to give participation in the performance of a risky asset while protecting the invested capital. This protection is however not perfect and the gap risk must be quantified. CPPI strategies are path-dependent and may have American exercise which makes their valuation complex. A naive description of the state of the portfolio would involve three or even four variables. In this paper we prove that the system can be described as a discrete-time Markov process in one single variable if the underlying asset follows a homogeneous process. This yields an efficient pricing scheme using transition probabilities. Our framework is flexible enough to handle most features of traded CPPIs including profit lock-in and other kinds of strategies with discrete-time reallocation.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

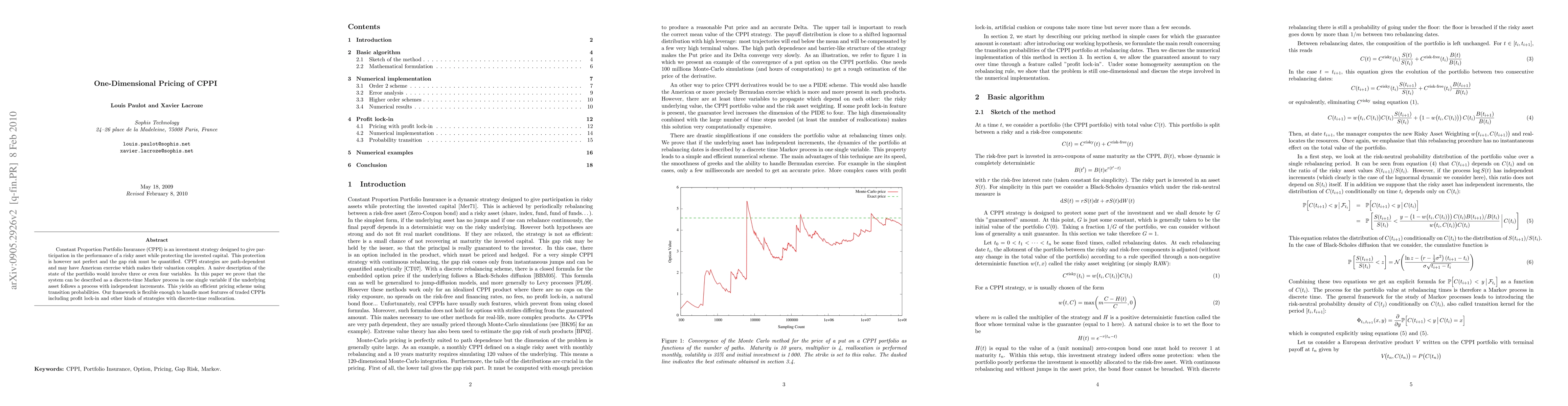

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOne-dimensional vs. Multi-dimensional Pricing in Blockchain Protocols

Aggelos Kiayias, Elias Koutsoupias, Giorgos Panagiotakos et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)