Authors

Summary

This paper studies a type of consumption preference where some adjustment costs are incured whenever the past spending maximum and the past spending minimum records are updated. This preference can capture the adverse effects of the historical consumption high and low values on the agent's consumption performance, thereby matching with some empirically observed smooth consumption patterns. By employing the dual transform, the smooth-fit conditions and the super-contact conditions, we obtain the closed-form solution of the dual PDE problem, and can characterize the optimal investment and consumption controls in the piecewise feedback form. We provide the rigorous proof of the verification theorem and compensate the theoretical findings with some numerical examples and financial implications.

AI Key Findings

Generated Jun 10, 2025

Methodology

The paper employs the dual transform, smooth-fit conditions, and super-contact conditions to solve a PDE problem, deriving closed-form solutions for optimal investment and consumption controls.

Key Results

- The paper obtains closed-form solutions for optimal investment and consumption controls in piecewise feedback form.

- Numerical examples and financial implications are provided to support the theoretical findings.

- The verification theorem is rigorously proven.

- Sensitivity analysis reveals how changes in model parameters affect consumption strategies and reference levels.

- The model captures empirically observed smooth consumption patterns by accounting for adjustment costs when updating historical consumption extremes.

Significance

This research contributes to understanding consumption preferences with adjustment costs, offering insights into how agents manage wealth under constraints that reflect real-world behavior, such as avoiding drastic changes in consumption patterns.

Technical Contribution

The paper presents a novel approach using the dual transform to solve a complex PDE problem, leading to explicit optimal controls for consumption and investment.

Novelty

The integration of adjustment costs with respect to multiple reference levels and the derivation of piecewise feedback optimal controls distinguish this work from previous models, providing a more nuanced description of consumption behavior.

Limitations

- The model assumes specific functional forms for utility and adjustment costs, which may not capture all nuances of human consumption behavior.

- The analysis is based on a deterministic framework, potentially overlooking the impact of stochastic market conditions on consumption strategies.

Future Work

- Further research could explore stochastic versions of the model to incorporate market uncertainties.

- Investigating the effects of additional behavioral factors, such as loss aversion or reference-dependent preferences, could extend the model's applicability.

Paper Details

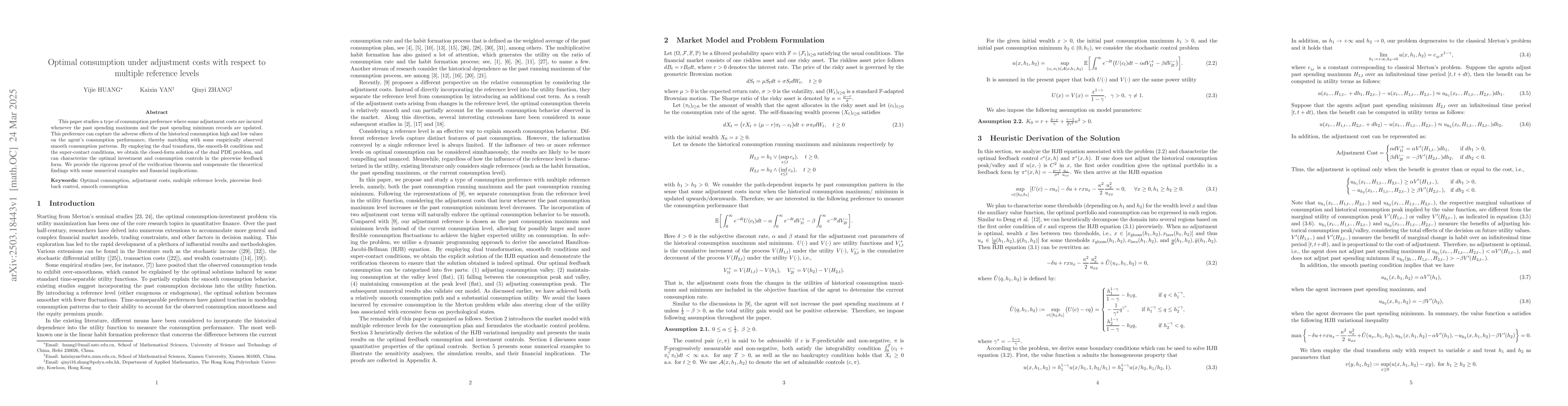

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOptimal Consumption with Reference to Past Spending Maximum

Xiang Yu, Huyen Pham, Xun Li et al.

Optimal consumption with loss aversion and reference to past spending maximum

Xiang Yu, Xun Li, Qinyi Zhang

No citations found for this paper.

Comments (0)