Summary

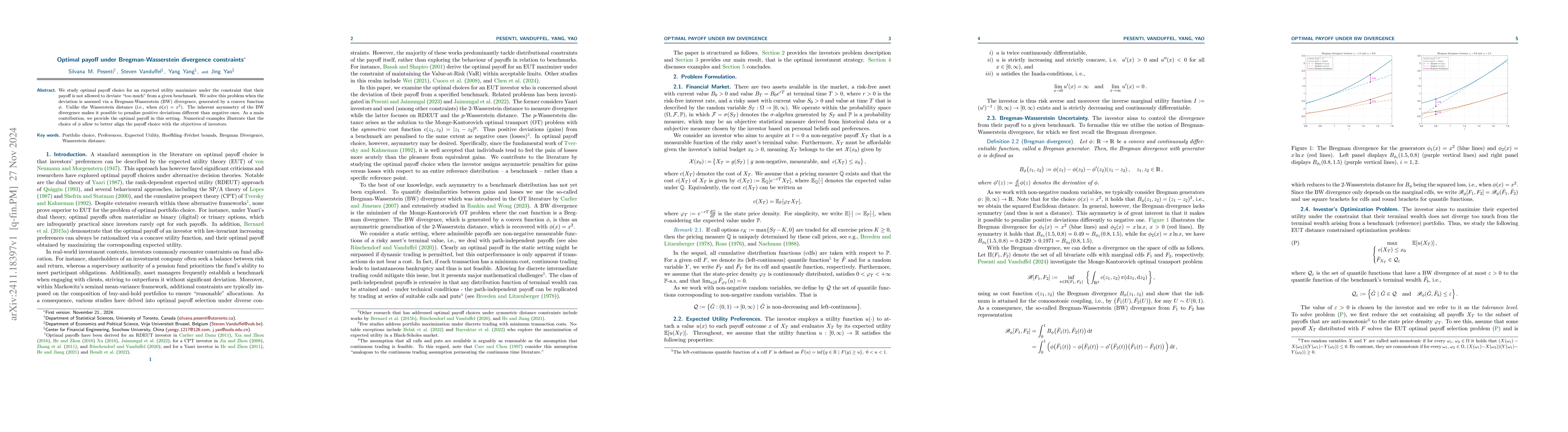

We study optimal payoff choice for an expected utility maximizer under the constraint that their payoff is not allowed to deviate ``too much'' from a given benchmark. We solve this problem when the deviation is assessed via a Bregman-Wasserstein (BW) divergence, generated by a convex function $\phi$. Unlike the Wasserstein distance (i.e., when $\phi(x)=x^2$). The inherent asymmetry of the BW divergence makes it possible to penalize positive deviations different than negative ones. As a main contribution, we provide the optimal payoff in this setting. Numerical examples illustrate that the choice of $\phi$ allow to better align the payoff choice with the objectives of investors.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersBregman-Wasserstein divergence: geometry and applications

Ting-Kam Leonard Wong, Cale Rankin

Error estimate for regularized optimal transport problems via Bregman divergence

Asuka Takatsu, Koya Sakakibara, Keiichi Morikuni

Accelerated Bregman Primal-Dual methods applied to Optimal Transport and Wasserstein Barycenter problems

Antonin Chambolle, Juan Pablo Contreras

No citations found for this paper.

Comments (0)