Authors

Summary

In this paper, we explore the portfolio allocation problem involving an uncertain covariance matrix. We calculate the expected value of the Constant Absolute Risk Aversion (CARA) utility function, marginalized over a distribution of covariance matrices. We show that marginalization introduces a logarithmic dependence on risk, as opposed to the linear dependence assumed in the mean-variance approach. Additionally, it leads to a decrease in the allocation level for higher uncertainties. Our proposed method extends the mean-variance approach by considering the uncertainty associated with future covariance matrices and expected returns, which is important for practical applications.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

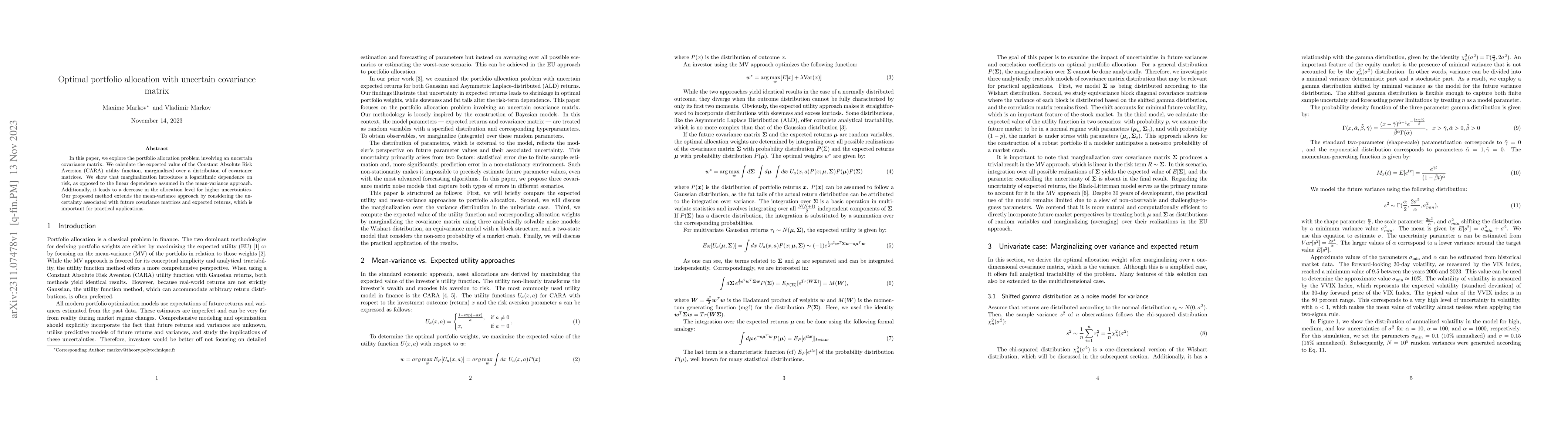

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)