Authors

Summary

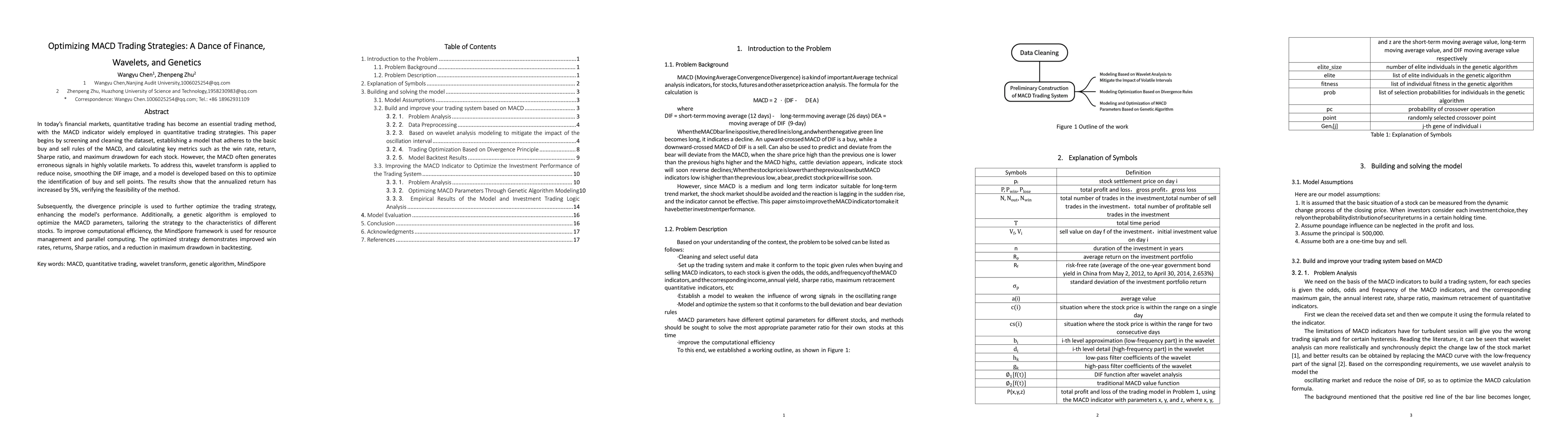

In today's financial markets, quantitative trading has become an essential trading method, with the MACD indicator widely employed in quantitative trading strategies. This paper begins by screening and cleaning the dataset, establishing a model that adheres to the basic buy and sell rules of the MACD, and calculating key metrics such as the win rate, return, Sharpe ratio, and maximum drawdown for each stock. However, the MACD often generates erroneous signals in highly volatile markets. To address this, wavelet transform is applied to reduce noise, smoothing the DIF image, and a model is developed based on this to optimize the identification of buy and sell points. The results show that the annualized return has increased by 5%, verifying the feasibility of the method. Subsequently, the divergence principle is used to further optimize the trading strategy, enhancing the model's performance. Additionally, a genetic algorithm is employed to optimize the MACD parameters, tailoring the strategy to the characteristics of different stocks. To improve computational efficiency, the MindSpore framework is used for resource management and parallel computing. The optimized strategy demonstrates improved win rates, returns, Sharpe ratios, and a reduction in maximum drawdown in backtesting.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersA comparative study of the MACD-base trading strategies: evidence from the US stock market

Pat Tong Chio

Deep Reinforcement Learning Strategies in Finance: Insights into Asset Holding, Trading Behavior, and Purchase Diversity

Alireza Mohammadshafie, Akram Mirzaeinia, Haseebullah Jumakhan et al.

Optimizing Quantile-based Trading Strategies in Electricity Arbitrage

Ciaran O'Connor, Joseph Collins, Steven Prestwich et al.

No citations found for this paper.

Comments (0)