Summary

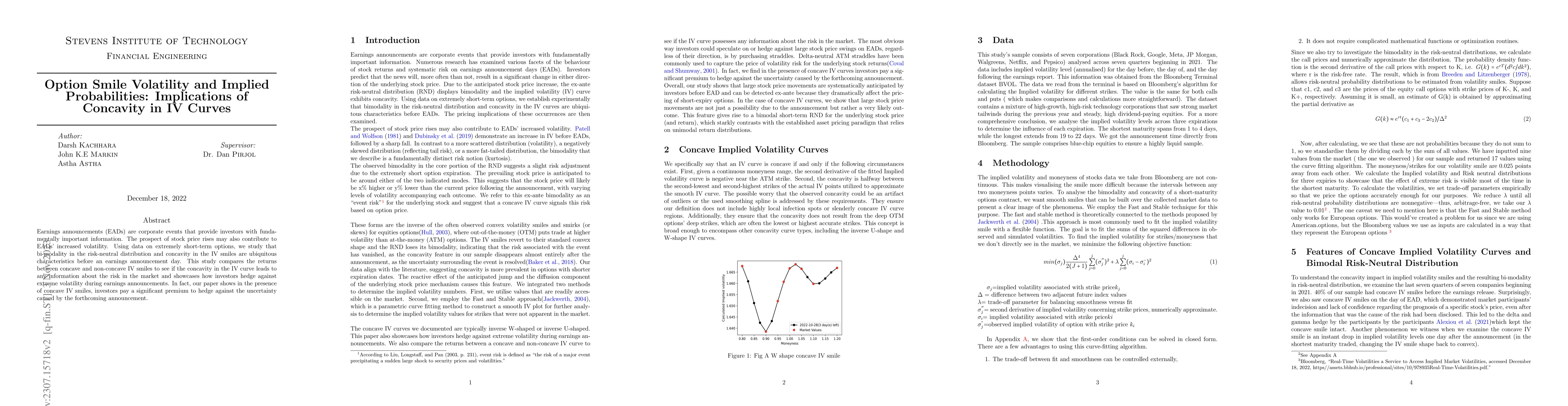

Earnings announcements (EADs) are corporate events that provide investors with fundamentally important information. The prospect of stock price rises may also contribute to EADs increased volatility. Using data on extremely short term options, we study that bimodality in the risk neutral distribution and concavity in the IV smiles are ubiquitous characteristics before an earnings announcement day. This study compares the returns between concave and non concave IV smiles to see if the concavity in the IV curve leads to any information about the risk in the market and showcases how investors hedge against extreme volatility during earnings announcements. In fact, our paper shows in the presence of concave IV smiles; investors pay a significant premium to hedge against the uncertainty caused by the forthcoming announcement.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSmile asymptotic for Bachelier Implied Volatility

Roberto Baviera, Michele Domenico Massaria

No citations found for this paper.

Comments (0)