Summary

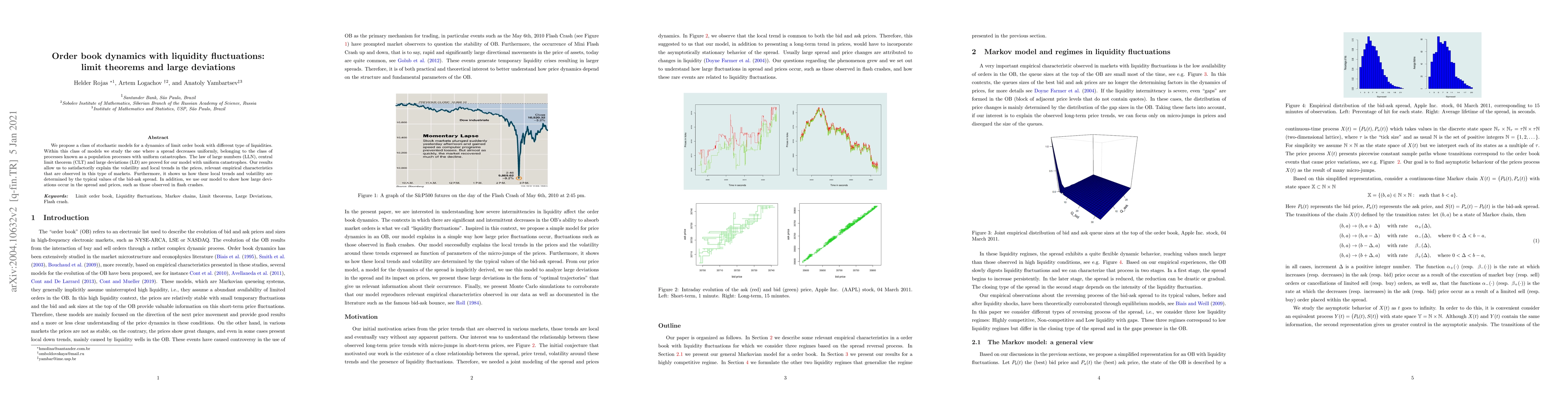

We propose a class of stochastic models for a dynamics of limit order book with different type of liquidities. Within this class of models we study the one where a spread decreases uniformly, belonging to the class of processes known as a population processes with uniform catastrophes. The law of large numbers (LLN), central limit theorem (CLT) and large deviations (LD) are proved for our model with uniform catastrophes. Our results allow us to satisfactorily explain the volatility and local trends in the prices, relevant empirical characteristics that are observed in this type of markets. Furthermore, it shows us how these local trends and volatility are determined by the typical values of the bid-ask spread. In addition, we use our model to show how large deviations occur in the spread and prices, such as those observed in flash crashes.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)