Summary

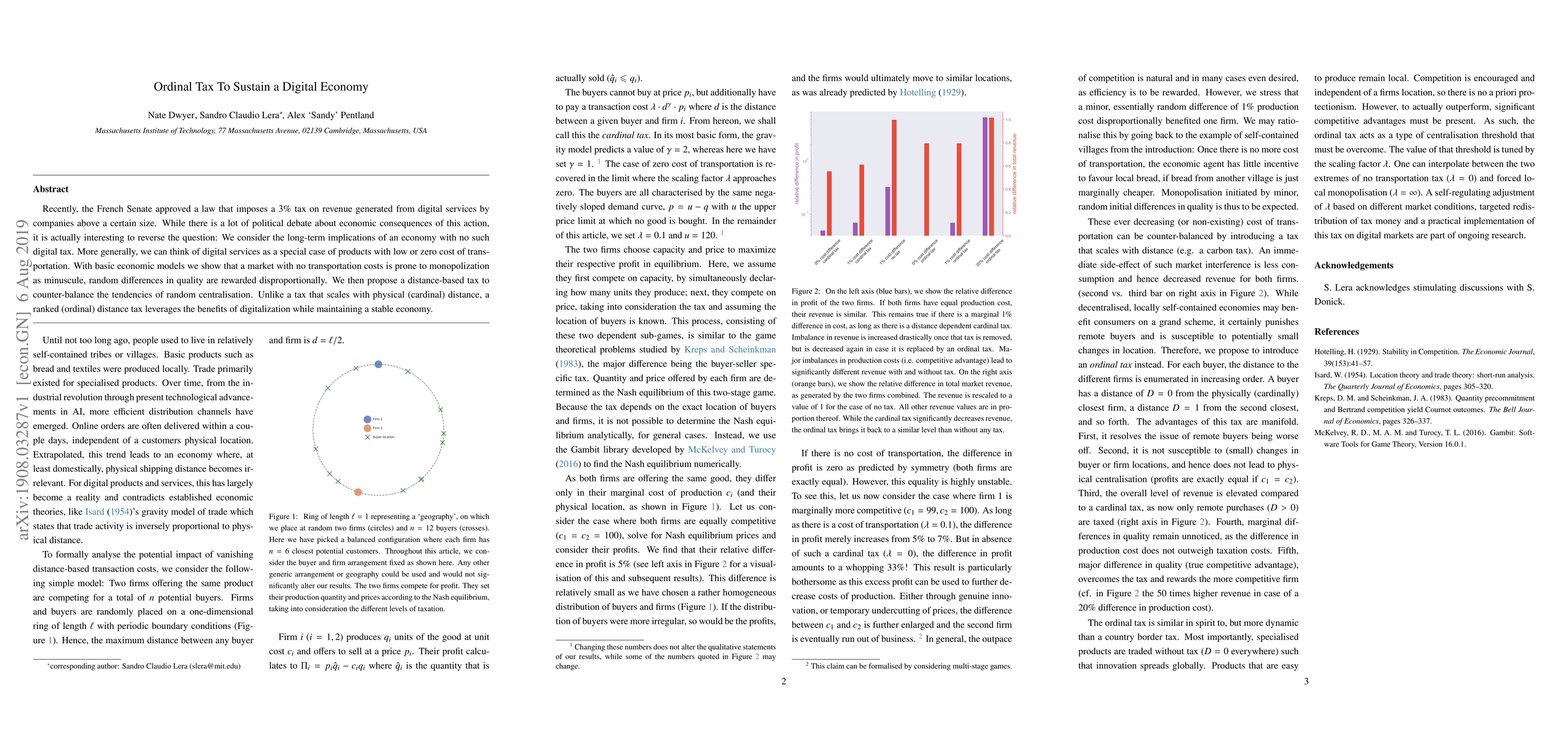

Recently, the French Senate approved a law that imposes a 3% tax on revenue generated from digital services by companies above a certain size. While there is a lot of political debate about economic consequences of this action, it is actually interesting to reverse the question: We consider the long-term implications of an economy with no such digital tax. More generally, we can think of digital services as a special case of products with low or zero cost of transportation. With basic economic models we show that a market with no transportation costs is prone to monopolization as minuscule, random differences in quality are rewarded disproportionally. We then propose a distance-based tax to counter-balance the tendencies of random centralisation. Unlike a tax that scales with physical (cardinal) distance, a ranked (ordinal) distance tax leverages the benefits of digitalization while maintaining a stable economy.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMaking Tax Smart: Feasibility of Distributed Ledger Technology for building tax compliance functionality to Central Bank Digital Currency

Panos Louvieris, Georgios Ioannou, Gareth White

Forecasting pandemic tax revenues in a small, open economy

Fabio Ashtar Telarico

The political economy of big data leaks: Uncovering the skeleton of tax evasion

Alex Arenas, Manlio De Domenico, Pier Luigi Sacco

No citations found for this paper.

Comments (0)