Summary

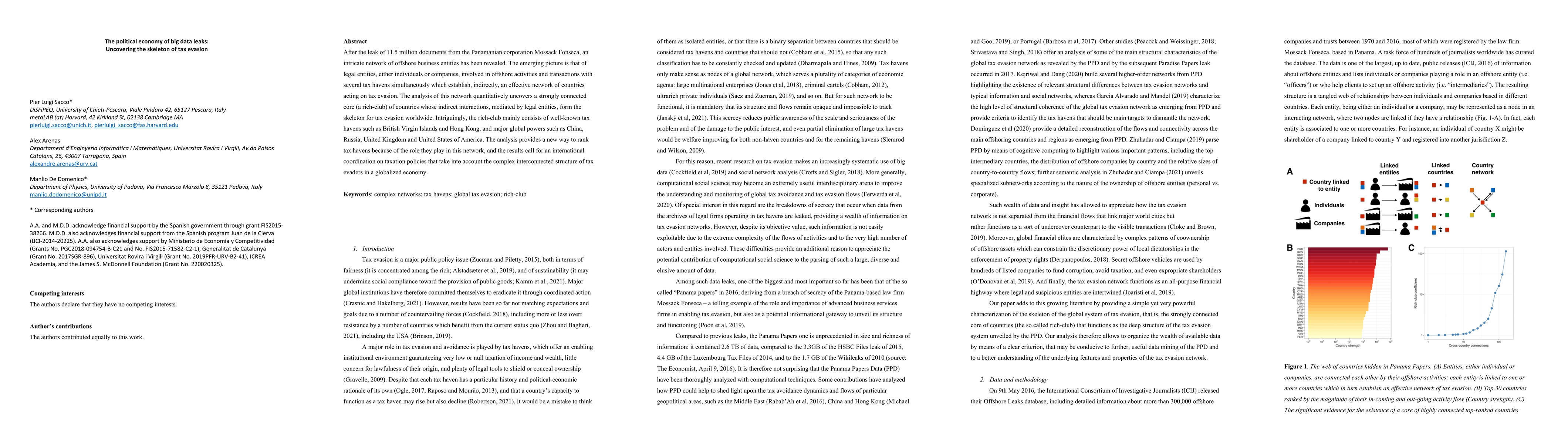

After the leak of 11.5 million documents from the Panamanian corporation Mossack Fonseca, an intricate network of offshore business entities has been revealed. The emerging picture is that of legal entities, either individuals or companies, involved in offshore activities and transactions with several tax havens simultaneously which establish, indirectly, an effective network of countries acting on tax evasion. The analysis of this network quantitatively uncovers a strongly connected core (a rich-club) of countries whose indirect interactions, mediated by legal entities, form the skeleton for tax evasion worldwide. Intriguingly, the rich-club mainly consists of well-known tax havens such as British Virgin Islands and Hong Kong, and major global powers such as China, Russia, United Kingdom and United States of America. The analysis provides a new way to rank tax havens because of the role they play in this network, and the results call for an international coordination on taxation policies that take into account the complex interconnected structure of tax evaders in a globalized economy.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)