Summary

This paper develops a method to upper-bound extreme-values of time-windowed risks for stochastic processes. Examples of such risks include the maximum average or 90% quantile of the current along a transmission line in any 5-minute window. This work casts the time-windowed risk analysis problem as an infinite-dimensional linear program in occupation measures. In particular, we employ the coherent risk measures of the mean and the expected shortfall (conditional value at risk) to define the maximal time-windowed risk along trajectories. The infinite-dimensional linear program must then be truncated into finite-dimensional optimization problems, such as by using the moment-sum of squares hierarchy of semidefinite programs. The infinite-dimensional linear program will have the same optimal value as the original nonconvex risk estimation task under compactness and regularity assumptions, and the sequence of semidefinite programs will converge to the true value under additional properties of algebraic characterization. The scheme is demonstrated for risk analysis of example stochastic processes.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

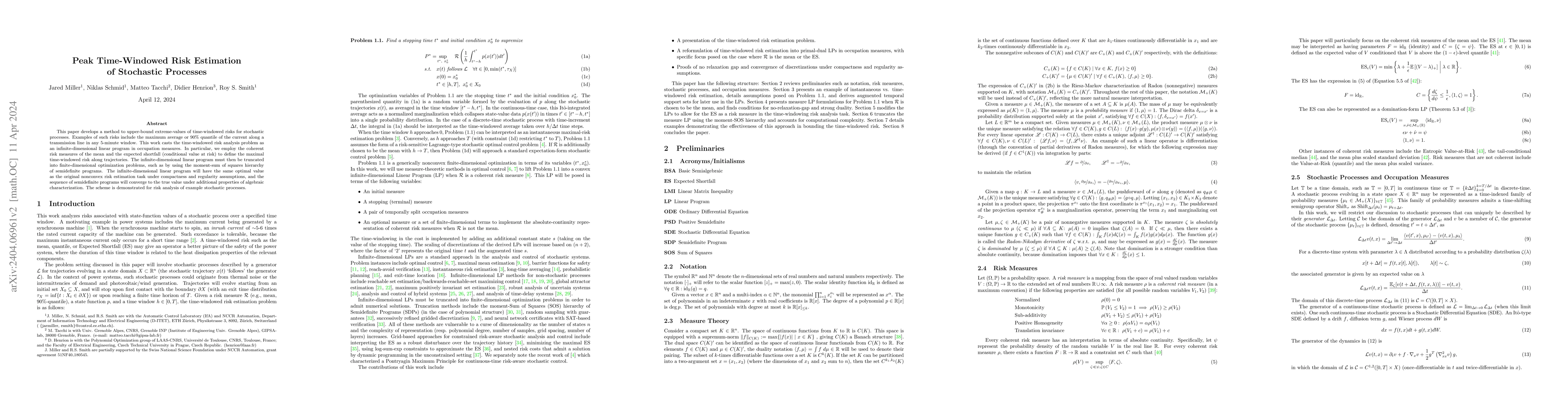

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPeak Value-at-Risk Estimation of Stochastic Processes using Occupation Measures

Mario Sznaier, Jared Miller, Matteo Tacchi et al.

STL Robustness Risk over Discrete-Time Stochastic Processes

Nikolai Matni, Lars Lindemann, George J. Pappas

| Title | Authors | Year | Actions |

|---|

Comments (0)